Financing the future: MyCredit helps schools upgrade, expand and go green

Sponsored by MyCredit

MyCredit Limited is a non-bank financial service institution offering loans and insurance services in Kenya.

It is licensed as a Digital Credit Provider (DCP) by the Central Bank of Kenya, with 10 years of operation and a presence in 50 locations across the country.

MyCredit is committed, passionate and zealous about supporting the education sector to scale, improve and modernise the infrastructure while making savings in the use of renewable energy(solar) and biogas.

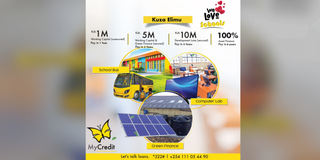

Our Kuza Elimu solutions offer school development finance through tailored products that fit educational institutions' cash flows and dynamic demographic needs. This product is designed to empower schools to upgrade their facilities, purchase essential assets like buses and vans and improve the overall learning environment.

With Kuza Elimu, school owners, principals and directors can access up to Kshs. 10 million in financing, repayable over a flexible period of up to 72 months. This solution provides 100% financing for brand new buses and vans, as well as projects that help schools reduce their energy costs by going off-grid through solar or biogas systems.

MyCredit remains dedicated to working with education stakeholders to accelerate growth, strengthen institutional capacity, and support long-term sustainability across Kenya’s learning ecosystem.

We are reacheable on www.mycredit.co.ke

talktous@mycredit.co.ke | *322# | +254 111 054 490