Business

Premium

Big firms buying Kenya’s carbon credits revealed

Giant US companies top the list of global players snapping up deals in Kenya’s nascent voluntary carbon market (VCM), a new report by the World Bank shows.

These deals have resulted in billions of shillings in earnings for conservancy groups and communities.

Records show that in 2022, Kenya was the second largest issuer of VCM carbon credits in Africa, after the Democratic Republic of the Congo — carrying on a trend of leaps over the past decade.

Since 2011 more than 59 tonnes of carbon credits have been issued to projects in Kenya, 83 percent of which have been through voluntary markets that are dominated by nature-based projects.

“Most credits generated from Kenya in voluntary markets have been issued for forestry and land use projects. These credits have been issued to four developers, three of which are based in Kenya: Wildlife Works Carbon, Chyulu Hills Conservation Trust, and Northern Rangelands Trust,” the World Bank said.

“They have generated carbon credits through reducing emissions from deforestation and forest degradation (REDD+) and sustainable grassland management projects to support local environment conservation efforts,” it added.

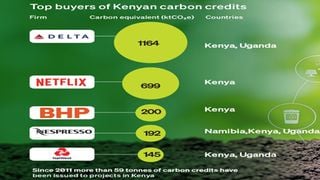

Records show that the deals in Kenya’s VCM are dominated by top global corporates including Delta Airlines, Netflix, Nespresso, Air France-KLM, Apple, BHP, and Kering. Others are Nedbank, Shell, Natwest Bank, and Zenlen Inc. For instance, Delta Airlines in 2021 bought a combined 1,164 kilotons of carbon equivalent (ktCO₂e) of carbon credits from Kenya and Uganda, while Netflix and BHP took up 600 and 200 ktCO₂e from Kenya, respectively. Nespresso in 2021 bought 192 ktCO₂e jointly from Kenya, Zimbabwe, and the DRC while UK lender, Natwest, took up a joint 145 ktCO₂e from Kenya and Uganda.

Besides the forestry programmes, household and community–based credits, specifically cooking stoves, are another significant type of credit generated in Kenya, though the World Bank points out that the enterprises behind these credits are more fragmented and largely rely on carbon credit revenue to achieve profitability.

A small portion of credits generated in Kenya has also been sold in compliance markets, issued through the Kyoto Protocol’s Clean Development Mechanism (CDM)— a United Nations-run carbon offset scheme allowing countries to fund greenhouse gas emissions-reducing projects in other countries and claim the saved emissions as part of their own efforts to meet international emissions targets.

The Kenya Electricity Generating Company (KenGen) is among Kenyan firms tapping fortunes through the CDM scheme. The Nairobi Securities Exchange-listed KenGen, for instance, in April 2023 revealed that it planned to sell 287,416 certified emission reduction credits (CERs), the bulk of it from its Olkaria 1 geothermal power project.

A CER is equivalent to one tonne of carbon dioxide (CO2) and they are part of emission reduction efforts under the Kyoto Protocol.

KenGen said it has been issued with a total of 4,682,639 CERs from its six projects registered under the Kyoto Protocol’s Clean Development Mechanism (CDM) with some potential reduction emissions of 1.5 million tCO2e annually.

“The projects have been issued with a total of 4,682,639 CERs from the second commitment period of CDM under the Kyoto Protocol. Out of these, the available CERs for sale under this tender is 287,416,” the company said as it invited buyers of the CERs.

President William Ruto has listed the carbon credits market as a key revenue source target for the country.

The Environment Ministry last year published draft regulations proposing that the government would take 25 percent of the revenue generated by private companies from the sale of carbon emission reduction credits and use it to fund sustainable development.

The draft regulations classify carbon credits projects as national, community or private, with the community ones giving five percent of the revenues to their respective county and another five percent to the national government’s consolidated fund.

The ministry in proposed regulations said that the government will establish a national carbon registry that will have details such as the number of carbon credits issued or recognised by Kenya.

There will also be registries for sectors such as aviation, forestry, or energy, where entities will pay a registration fee to be recognised and become eligible for accumulating carbon credits.

No person will be allowed to operate a carbon market project without being registered. Those seeking to list carbon projects will have to disclose ownership and indicate how their project will contribute to nationally determined contributions and the number of jobs to be created.