Premium

Dear Property Stakeholders: This is what the next generation of buyers want

A studio apartment. Modern housing takes center stage in attracting Gen Zs.

What you need to know:

- The biggest barrier that stands in the way of Gen Zs and property investments is money! Investing in property is very expensive.

- As we generate content targeting Gen Zs, it will critical that we educate and inform.

- Most young people get their information on how to invest from family, friends or social media influencers.

As the rest of the world stereotypes and makes memes about Gen Zs, clever business owners are busy tapping into the new skills they bring to the table while others are figuring out how to turn them into loyal customers.

If you are in the property market, as a developer, land seller, agent, bank or advertiser, this article will help you understand what opportunities Gen Zs represent and the right way to engage them.

Martin Gitonga, a Creative Director with over 20 years’ experience in developing and implementing creative multi-media campaigns tells us what it will take to get through to the upcoming generation of property investors.

Then Austin Kisegei, a Gen Z, and show host tells us what we need to know about his generation as we break down results from a simple poll presented to 39 Gen Zs.

Austin Kisegei, 22 show host and video editor

I host a video talk show called The Zee Tribe. It primarily allows Gen Zs to express their opinions on various topics in an open discussion.

Through my work I interact with people from my generation and based on these interactions, I can say Gen Zs are an amazing generation. In this “second renaissance” where the world ushers in the digital era, we are at the forefront of embracing change and shaping the world for generations to come.

Austin Kisegei, 22 is a show host and video editor.

Like other generations we’ve been stereotyped heavily as everyone adjusts to our presence in the workplace and other avenues. Gen Zs are perceived as inferior in terms of resilience and emotional maturity.

Some people think we live in a fairy-tale, and that our depiction of the world is misconstrued vis-à-vis reality.

While all these claims may be true for a few Gen Zs, the majority of us are the exact opposite. We were not born in a generation that goes to war or spends days toiling on the farm under the hot African sun.

But we have mastered soft skills, and our general knowledge of technology gives us a clear edge over the older generations.

We wear our emotions and express our views freely, and I think this shows emotional maturity, not fragility. We are not afraid to love, and we make friends from all walks of life.

One of the highlights that Gen Zs will be known for is how we balance work and play. We have perfected the art of playful work and making money as we play.

A Gen Z who loves to play video games will open a gaming joint and make money doing what he loves. A girl who loves dancing makes money through Tiktok videos.

Competing with alternative investments

Many of us have come to terms with the fact that achieving life goals is like a journey that is enjoyed more than the destination.

On investments, other than property, there’s a lot of hype around cryptocurrency and NFTs, despite the recent unpredictability of the cashless currency.

NFTs, which also rely on blockchain technology offer a way to buy tokens that appreciate over time and can yield very lucrative returns on investment.

NFTs and Cryptocurrency are some of the non-traditional investments most Gen Zs would consider. But we are still keen on investing in traditional assets. Modern housing takes the center stage in attracting Gen Zs.

We are attracted to fine finishing, spacious living rooms, ultramodern glass pavilions, luxurious furniture and fancy apartments.

If I was to invest in property my first consideration would be pricing. Like any other investor, I believe, the initial cost often determines the trajectory of an investment.

The Purpose of that investment is also important to me. Some dream of buying land to build apartments while others envision building their own houses in a quiet neighbourhood.

And lastly, a location which dictates a property’s price and status.

Many focused Gen Zs whom I have engaged express interest in real estate developments.

A lot of them would love to buy land, build houses, and sell their property. Unfortunately, there is only so much we can do in the property sector outside what is already being done by our predecessors.

I believe Gen Zs take an interest in all property asset classes.

The biggest barrier that stands in the way of Gen Zs and property investments is money! Investing in property is very expensive.

While mortgages and loans can allow one to purchase property at a lower initial cost, such plans are not accessible to most young people.

“Infortainment” is king now

When it comes to content and adverts by property companies, content on real estate is usually super expensive property that only one per cent of the population can afford.

Developers should, for instance, advertise a property that is more affordable to Gen Zs as well as provides a long-term payment plan.

I believe social media holds the key to getting more Gen Zs to focus on property investments.

Tiktok and Instagram are some of the best channels to deliver the message. I think a one-minute video showing the property, location, payment plan and so on will do.

Tiktok and Instagram are some of the best channels to deliver the message. A one-minute video showing the property, location, payment plan and so on will do.

One of the biggest mistakes property companies make when generating content or adverts is focusing on the information. We want infotainment.

Using a linear approach, showing real footage of a house or property, with a dull voiceover of a middle-aged man is not amusing.

Inclusivity will work better. For instance, engaging youthful voices will help Gen Zs relate to the content. Simply do a review of the property in a fun and engaging way and keep it short.

Martin Gitonga, Creative Director at ARCrayon Communications

I’ve spent more than 20 years developing and implementing campaigns in both electronic and print media.

I have worked on campaigns for various multinationals and part of my experience also comes from working in Ethiopia as an Art Director.

When it comes to turning Gen Zs into loyal and informed investors, brands should start when the young audiences are in high school and during the transition to tertiary institutions.

Martin Gitonga is a Creative Director at ARCrayon Communications

Gen Zs are quite exposed, aspirational, informed and opinionated.

During this transitional period in high school, they make up their mind about career choices.

This is the best phase to interest them in the property so that they develop an interest and familiarity with the benefits, costs and implications on their lifestyle.

However, this engagement needs to be innovative - they have no time, or interest in reading a voluminous and technical, 10-page Investment Memorandum on an investment.

Internet penetration, affordable smartphones, and social media usage mean that they consume targeted information on a daily basis, and keep up with the latest trends and news from across the board.

The pressure on them to be financially independent so as to afford the aspirational lifestyle portrayed by influencers is also high.

Hence, when targeting them with information (whether advertisements or others), it should be sleek, snazzy and related to their desired lifestyle, accompanied by appealing visuals and audio.

Gen Zs prefer short, succinct content that addresses the opportunity or challenge and offers pragmatic, easily understandable solutions.

They also love choice, so the overarching message must be flexible to accommodate their individualism without compromising the quality of the product.

Changing media

One thing to note is that hard copies are going out of fad while e-copy is catching on as it is sharable on social media or email.

This means that short videos, with great delivery, and e-copies reign. If a clip needs voice-over, the voice must be likeable and relatable.

The maximum length for both video and audio is 60 seconds for cost considerations and also attention span.

Popular social media channels are Facebook Reels, Instagram, WhatsApp, TikTok, YouTube videos, Telegram, Twitter, LinkedIn and Snapchat.

These can be used complementarily with either an organic or a boosted push, partnerships with influencers, popular personalities and thought leaders.

Radio still remains king in Kenya’s mainstream media in terms of reach and believability (especially shows with relatable presenters) and as such it should be part of the strategy because of the challenges of mis-and dis-information on social media.

One factor to note is that hard copies are going out of fad while e-copy is catching on as it is sharable on social media or email.

Besides advertising and generating content on both new and traditional media, offline efforts can pay off too in connecting with Gen Zs.

Fun events, theme nights on campus and roadshows, with trivia, raffle tickets or timeless keepsakes or mementoes, well-organized, thought-leadership conferences and hackathons...there is no silver bullet here.

So yes, a road trip to tour the project site, with fun activities could also work magic.

As brands strive to attract the attention of Gen Zs, retaining loyal customers from older generations is also critical. Great brands take a long-term view of their products, services and solutions by focusing on the pain points of their target market and offering a simple, affordable product.

Building trust and an emotional connection with the consumer is key. Therefore, the right balance can be achieved by moving away from being transactional to building a trustworthy relationship, delivering on the brand promise, meeting and exceeding expectations, and resolving some of the pesky issues in property ownership.

Bridging Knowledge gaps

As we generate content targeting Gen Zs, it will critical that we educate and inform.

Most young people get their information on how to invest from family, friends or social media influencers.

Often, these sources do not represent all the investment options. Fortunately, we have depth and breadth in the array of property asset classes available.

For example, one doesn't have to fork out Sh3 million for a studio or a one-bedroom apartment upfront, all at once.

One may choose to become a part-owner of a prestigious commercial or residential property in Kenya today, by investing through collective investment schemes (CIS), or Real Estate Investment Trusts (REITs).

We also have fractional shares and ownership. However, the companies offering these investments are hardly known. They need to get out there and engage in consumer education en masse and dispel any fears about this investment option.

Many Kenyans are risk averse owing to multiple unfortunate incidents of investors being ripped off by unscrupulous developers.

This has contributed to the fear of property investments. The government, judicial services, law enforcement, financial services firms and regulators must do more to protect innocent investors, hold project developers and promoters to account, and very importantly create a Kenya Real Estate Deposit protection fund.

Changing preference for location and buying timelines

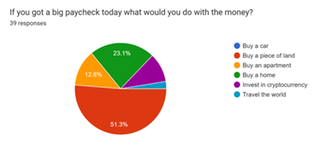

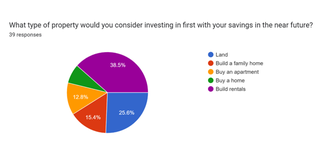

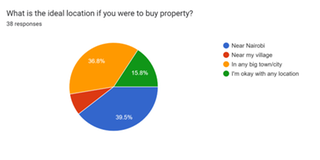

To establish whether Gen Zs will present a different buyer behaviour once they start buying property, DN2 property presented 4 questions to Gen Zs in a simple poll, with the aim of measuring three metrics: First, what property asset classes are attractive to this new generation.

Second, will their preference for location shift and third, are they bound to start buying property at an earlier age or at a later age?

39 Gen Zs aged between 20 and 25 responded to the questions and the results show that Gen Zs’ preferences are changing in some areas.

In summary:

Gen Zs are still attracted to traditional investments with land and rentals still retaining their position as the symbols of success and financial freedom.

51.3 Gen Zs would invest in the land if they got a big paycheck today. However, they are also interested in emerging investment options as 10.3 per cent would invest such money in cryptocurrency.

No Gen Z would buy a car while only 2.6 per cent would travel the world. To countercheck whether Gen Zs were any different from the older generations.

The same question was presented to millennials and 24 of them responded, painting a picture of extreme differences when it comes to preferences and priorities.

While 55 per cent of the 24 millennials who responded would invest in property by buying a home, 23 per cent would buy a car, 18 per cent would travel the world and only 4 per cent would invest in cryptocurrency.

Gen Zs have also proven to be early settlers as most of them said the best time to start investing in either in your mid-twenties or “as soon as you start earning” though there were outliers who believe the 30s and 35 to be a realistic time to start investing.

On location, there is a significant shift in preferences. Nairobi may not be as prime as it used to be as only 39.5 per cent would prioritize buying properties near the capital.

A significant 36.8 per cent will buy in any big town or city, while only 7.9 per cent will buy near their village and 15.8 per cent are okay with any location.