How Kuscco top bosses siphoned Sh580m annually

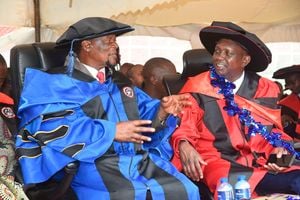

Cabinet Secretary for Cooperatives and Micro and Small Enterprise Simon Chelugui (right) flanked by Commissioner for Cooperatives David Obonyo addresses journalists at the NSSF Building.

What you need to know:

- Cooperatives and Micro, Small and Medium Enterprises (MSMEs) Cabinet Secretary Simon Chelugui said on Monday he had dismissed Kuscco’s entire board and pledged to recover the lost billions in fresh efforts to save the struggling firm.

- The ministry had ordered an inquiry into the activities of Kuscco by the Commissioner of Cooperatives in October last year, on suspicion that it had been engaging in illegal deposit-taking business, sparked by its inability to meet its financial obligations.

Top executives of Kenya Union of Savings and Credit Cooperative Society (Kuscco) siphoned Sh587.6 million annually over a decade, in a series of transactions including transferring money to their own accounts and tapping unsupported loans, plunging members into multi-billion shillings loss.

A government-backed special audit on Kuscco has revealed the executives rode on weak internal management structure to manipulate books of accounts and carry out the irregular transactions that cumulatively cost the society over Sh6.56 billion between February 2013 and April 2024.

Audit and advisory firm Grant Thornton, which scrutinised Kuscco’s books, has disclosed misappropriation of members’ funds through illegal withdrawals, cash transfers and engagement in illegal or unlicensed activities, ostensibly steered by top officials.

Kuscco was registered in 1973 as an umbrella lobby institution for Saccos, before morphing into an unregulated deposit-taking operation with different subsidiaries including Kuscco Mutual Assurance and Kuscco Housing.

Currently, Kuscco has a membership of about 4,168 Saccos, and holds deposits estimated at Sh18.9 billion.

Cooperatives and Micro, Small and Medium Enterprises (MSMEs) Cabinet Secretary Simon Chelugui said on Monday he had dismissed Kuscco’s entire board and pledged to recover the lost billions in fresh efforts to save the struggling firm.

“Preliminary findings indicate systemic deficiencies in the management of resources, including the creative and unreliable financial records,” Mr Chelugui told reporters during a media briefing at his office yesterday.

“We will pursue all those culpable, all those that are involved, those who will be mentioned, until we recover every shilling owed to Kuscco members.”

The special audit was ordered by the ministry in January this year, after it was established that Kuscco’s books had been audited by unlicensed entities for the last two years, the period when it came under financial distress.

The ministry had ordered an inquiry into the activities of Kuscco by the Commissioner of Cooperatives in October last year, on suspicion that it had been engaging in illegal deposit-taking business, sparked by its inability to meet its financial obligations.

Initial findings had revealed that Kuscco had been commingling union funds between different programmes, including housing and insurance, without clear terms, and consequently was not able to release member deposits.

The Grant Thornton audit has shown there were high cash withdrawals of Sh5.47 billion between February 2013 and April 2024, which averages Sh40.79 million monthly. The auditor termed the cash withdrawal “out of character”, suggesting they were irregular and abnormal.

This included suspicious transfers worth Sh318.16 million that were made to the company secretary of Kuscco Housing.

Senior Kuscco staff and directors tapped loans amounting to Sh61.5 million, with Sh50 million going to the group managing director, Sh7 million to the head of Kuscco Housing Co-operative and Sh4.5 million directed to the company secretary of Kuscco Housing Society.

The audit further showed there were cash transfers to the personal accounts of three executives, with one top manager receiving Sh67.04 million, with two of his assistants getting Sh118.05 million and Sh15.99 million respectively.

In mid-January, Kuscco, without giving reasons, announced it had parted ways with its long serving chairman George Magutu and group managing director George Ototo.

Grant Thornton scrutiny also revealed that there was a double purchase of the same land at Sh80.55 million. There was also a Sh434.16 million suspicious cash transfer to insurance agencies.

According to Mr Chelugui, the irregular cash transfers to unnamed insurance agencies were “purported to be payment of commissions for services rendered to insurance services.”

Kuscco officials have also been found to have moved money between subsidiaries without following procedure.

According to the audit, Kuscco opened and operated a Fosa-Kusasa, which was neither a registered Fosa nor a microfinance. The officials rode on Kusasa to open an irregular account under Kuscco CIF, where customers’ cheques were received, endorsed and deposited at the Kuscco account for clearing.

Mr Chelugui said yesterday despite Kuscco incurring losses, it proceeded to declare bonuses, dividends and interests to members against the industry practice that only allows for such when an entity posts profits.

He said in light of the “egregious lapses” discovered after the audit, a consultative meeting convened on April 25, 2024 with representatives from depositors reached a unanimous decision to dismiss Kuscco’s entire board.

“It was concluded that the current board of directors has failed in its duty to steer the union effectively. Consequently, in the interest of ensuring accountability and restoring confidence, the ministry has taken a decisive action on this matter,” said Mr Chelugui.

He has directed the Commissioner for Cooperative Development to appoint an interim board of 15 members from affiliate cooperative, to oversee the “transformation and rehabilitation” of the union.

According to the ministry, Kuscco is registered as a lobby group for Saccos in Kenya, but is not in itself licensed to engage in the business of taking deposits and giving loans.