Premium

Inside push to bar MPs, ministers from creating burdensome State corporations

The Third National Wage Bill Conference at the Bomas of Kenya on April 17, 2024.

The State Corporations Advisory Committee (SCAC) is pushing for MPs and Cabinet secretaries (CSs) to be barred from initiating the creation of new parastatals, on the back of the proliferation of loss-making entities.

The SCAC accuses MPs and ministers of abusing laws allowing them to establish parastatals through Acts of Parliament and the Companies Act, coming up with dozens of corporations that have ended up bleeding public coffers.

The committee, whose main mandate is to recommend required reforms for State corporations to the President, raises concerns that MPs and CSs are introducing new corporations just for the sake of it and for personal interests, at the expense of taxpayers, who end up bearing the burden of the loss-making entities.

MPs are allowed to initiate the creation of state corporations by drafting bills in their private member capacity, while CSs have also been empowered by acts of parliament to establish state corporations.

“Oftentimes, private member motions are driven by personal interests or the proceeds of other interested parties out there. Such Bills end up in Acts of Parliament and create state corporations without a proper feasibility study and consideration of their financial implications,” says SCAC chairperson Philip Mong’ony.

He says most MPs have exploited the legal provision to introduce subsidiaries for existing State corporations, most of which are in the red.

Investing in business

Ministers introduce State corporations under the Companies Act, which simply means the government investing in a business that has been registered by the registrar of companies.

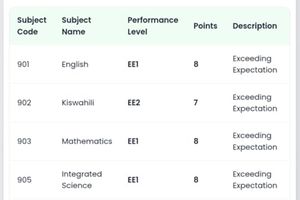

Data by SCAC shows that the national government has 349 State corporations, out of which 230 have been established through Acts of Parliament, 65 have been under the Companies Act and 54 through legal notices and regulations, also anchored on Acts of Parliament.

“Out of the 65 established under the Companies Act, 27—41 percent are subsidiaries of other State corporations. Establishment of subsidiaries is an area of interest as it is often exploited to create corporations, resulting in financial burden and possible wastage in any incurred costs that are ultimately serviced by the exchequer,” said SCAC in a presentation during the National Wage Bill Conference last week.

“No private members Bills on the establishment of state corporations should be entertained, and perhaps the President will have to issue an executive order,” said Mr Mong’ony.

The committee noted that while efficiency and profitability ought to be key determinants for corporations to open up subsidiaries, many have been reckless and created loss-making entities that cannot sustain themselves. It asked the President to issue an executive order barring Parliament and Cabinet ministers from introducing new State firms.

“We are in this problem because of incessant private members’ motions that go into creating state corporations. No private Members’ Bills should be entertained. Any laws that grant a CS the power to create a State corporation should be amended. State corporations should not create subsidiaries without going through PFM (Public Finance Management) regulations,” he said.

Wage bill

Among subsidiaries established under the Companies Act are Kipchabo Tea Factory, Mt Elgon Lodge, Mwea Rice Mills, Kenya Petroleum Refineries Ltd, Rivatex East Africa Ltd, Simlaw Seeds Kenya Ltd, Simlaw Seeds Rwanda, Simlaw Seeds Uganda, Sunset Hotel Kisumu and Western Kenya Rice Mills Ltd.

Ministers have also established the Kenya Institute of Primate Research, Kenya Education Management Institute, and the Veterinary Medicines Directorate through regulations.

Overall, State corporations form about half of the national government in terms of workforce and wage bill, and SCAC notes that it is key that the process of their creation is tightened to avoid burdening taxpayers with many, useless corporations.

“The overriding legal framework of establishing state corporations is the PFM Act 2012. By proper means, a State corporation should only be established under PFM requirements, where no State corporation shall be established unless by Cabinet approval, upon recommendation,” said Mr Mong’ony.

Parliament and Cabinet ministers create parastatals despite the failure of the government to implement reforms recommended previously, mainly the presidential Task Force On Parastatal Reforms in 2013, whose main recommendations were the merging and restructuring of non-performing corporations to boost their efficiency.

Arrest the situation

The task force recommended a reduction of State-owned firms from 262 to 187 by merging some and scrapping others.

“Many Kenyans don’t know that the parastatals are one of the largest sectors in the civil service, employing more than 200,000 people and having a wage bill of at least Sh150 billion,” constitutional adviser to then-President Uhuru Kenyatta, Abdikadir Mohammed, who chaired the task force, said in 2014.

Since then, 87 new State corporations have been created to see their number stand at 349, mainly through subsidiaries and new corporations without proper feasibility studies.

The SCAC noted that addressing the numbers and processes of establishing State corporations would be key to the government’s pursuit of a sustainable public wage bill and calls for tough measures to arrest the situation.

“This may involve implementing tighter controls, enhancing oversight mechanisms for us to avoid the wastage and improper utilisation of public funds,” said Mr Mong’ony.