GRAPHIC | CHRISPUS BARGORETT | NMG

|Business

Premium

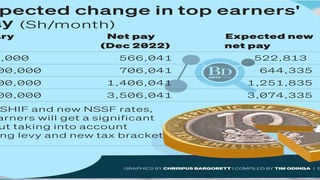

Payslip deductions for top earners rise by Sh430,000

Kenya’s top earners are set to take an additional hit of up to Sh430,000 once all the new tax measures and levies introduced by the government over the past year are factored into their payslips.

The top earners, who are already subject to higher Pay As You Earn (PAYE) rates on income above Sh500,000 per month, are now set to cede significantly much more once the government starts levying the enhanced Social Health Insurance Fund (SHIF) at 2.75 percent of gross monthly pay.

The deductions have been amplified by the lack of a cap on the SHIF and the housing levy despite proposals to do so when the two charges were in the early stages of formulation.

The changes that have come in progressively since last year include the introduction of two new top PAYE brackets of 32.5 percent on income between Sh500,000 and Sh800,000 and 35 percent for income above Sh800,000. Such income was previously levied PAYE at 30 percent.

The housing levy is charged at 1.5 percent of monthly pay and matched by the employer. Monthly contributions made to the National Social Security Fund (NSSF) have also been enhanced from a flat Sh200 to a two-tier plan which will from February amount to Sh2,160 for workers earning more than Sh18,000 per month.

Workers are also set to pay 2.75 percent of their gross pay towards the SHIF, marking a significant increase from the Sh1,700 monthly contributions currently levied at the top end.

Once all the levies and charges are in place, those earning Sh800,000 per month will see a Sh43,227 increase in their monthly deductions to Sh227,186 compared to what they were ceding in December 2022.

The higher deductions are on account of a Sh8,967 increase in PAYE, a Sh20,300 increase in their health fund contribution, and the housing levy charge of Sh12,000.

For those earning Sh1 million per month, the overall deductions will go up by Sh61,705 to Sh355,655, while those on Sh2 million per month will take an additional hit of Sh154,205, taking their deductions to Sh748,165.

At the top end of the pay scale, an executive earning Sh5 million a month will see an increase of Sh431,705 in their deductions, which will rise to an estimated Sh1.93 million.

This top pay category of Sh5 million per month currently attracts PAYE of Sh1.71 million and a housing levy charge of Sh75,000, while their health fund deduction is set to stand at Sh137,500 once the SHIF contributions kick in.

However, only top executives of selected firms earn monthly salaries that run into the millions, meaning that the benefit to the government in terms of higher tax revenue is likely to be limited at best.

The overall number of workers earning above Sh100,000 per month is in the minority of the country’s total workforce, as per official statistics. By the end of 2022, data from the Kenya National Bureau of Statistics (KNBS) shows, Kenya had only 371,893 workers in formal employment taking home Sh100,000 and above, accounting for 12.3 percent of the 3.02 million wage employees in the country. The KNBS does not, however, give a breakdown of income groups above Sh100,000 per month.

The large number of workers in the lower pay scales means that they will collectively be funding the bulk of the additional taxes the State is eyeing from the enhanced levies and fees.

For years, the government had sought ways of raising the tax contribution of top earners and the affluent in order to enhance equity in the funding of the exchequer, but such efforts often met legislative headwinds.

In 2018, a proposal by the Treasury to bring in a new top tax bracket of 35 percent for pay above Sh750,000 was withdrawn after meeting opposition during the public consultations phase.

Another recent proposal has been the introduction of a wealth tax, which generally includes taxes on property or land, income derived from ownership of land, personal capital income (dividends, interest and capital gains tax), inheritance and gift taxes.

A wealth tax would, however, need proper enforcement of laws compelling companies to reveal information on beneficial ownership, which would help the taxman identify the high net-worth individuals for easy administration.