Premium

Salaried Kenyans to feel tax pinch in President Ruto’s inaugural budget

National Treasury Cabinet Secretary Njuguna Ndung’u raided the pockets of salaried workers and expanded consumption taxes to plug holes in Kenya Kwanza’s first Budget intended to raise revenue for the payment of ballooning public debt and lay the foundation for economic recovery.

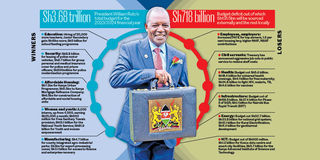

Winners and losers in President William Ruto's maiden budget presented by National Treasury Cabinet Secretary Njuguna Ndung’u on June 15, 2023.

Prof Ndung’u, in a three-and-a-half hour presentation of the Sh3.7 trillion Budget statement, promised to deliver the country from the brink of an economically disastrous debt default, but only on the back of a raft of tax measures that will further raise the already high cost of living.

Salaried workers will surrender nearly 40 per cent of their monthly pay to the government in the form of a 35 per cent income tax for top earners, 1.5 per cent housing levy and 2.7 per cent National Health Insurance Fund deductions once the Budget proposals are effected.

Small businesses making sales of Sh1 million a year will be required to pay a 3 per cent turnover tax regardless of whether they make a profit or loss, while a doubling of VAT on fuel will end ripples through the economy by way of higher costs of goods and services.

“Kenya’s public debt remains sustainable but with elevated risks of debt distress due to persistent global shocks that adversely affected liquidity ratios. The external debt service is projected to increase to Sh475.6 billion from Sh242.1 billion in the financial year 2022/23, mainly reflecting redemption of the $2 billion Eurobond, approximately Sh241.8 billion. The government remains committed to meeting all maturing obligations, as and when they fall due, including the maturing Eurobond,” said Prof Ndung’u in his maiden Budget speech.

National Treasury Cabinet Secretary Njuguna Ndung’u arriving at Parliament Buildings for the reading of the 2023/24 Budget Statement on June 15, 2023

Bottom-Up Economic Transformation Agenda

While allocating more money to President William Ruto’s Bottom Up Economic Transformation Agenda, Prof Ndung’u named five “strategic sectors” that are projected to have the largest impact and linkages to the economy as the foundation for the projected recovery.

“These include agricultural transformation, micro, small and medium enterprises, housing and settlement, healthcare and digital superhighway and creative industry,” said the CS.

The Hustlers Fund, a key plank of Kenya Kwanza’s campaign promises, will get an additional Sh10 billion in the coming financial year, while the Youth Enterprise Development Fund will get Sh175 million, Women Enterprise Fund Sh182.8 million and the SMEs in manufacturing Sh300 million in additional allocation “to promote accessibility to affordable credit to most Kenyans at the bottom of the pyramid”.

Prof Ndung’u allocated Sh35.3 billion to the controversial housing and settlement plan, terming it a job-creation initiative, intended to “reduce the proliferation of slums and hence preserve human dignity. Additionally, it aims to create quality jobs for over 100,000 youths”. He said the cash will be spent on the construction of markets, affordable homes and social housing units.

President William Ruto with grader operator Patrick Mbindyo during the groundbreaking ceremony for the proposed Shauri Moyo 'A' affordable housing project on January 27, 2023.

The Universal Health Coverage programme, which stalled during former President Uhuru Kenyatta’s administration, will get Sh141 billion to provide subsidised healthcare.

Parastatal workers, however, face an uncertain future after Treasury instructed the State Corporations Advisory Committee to immediately embark on an aggressive rationalisation programme to keep the public workforce lean.

Employers will also dig deeper into their pockets to fund the 1.5 per cent housing levy by matching their employees’ deductions, a move that could see them declare mass redundancies.

Education

Education has been allocated Sh628.6 billion for, among others, the recruitment of an additional 20,000 teachers (Sh4.8 billion)and increased capitation grants for junior secondary schools (Sh25.5 billion), free primary education (Sh12.5 billion) and free day secondary education (Sh65.4 billion). Some Sh5 billion has been set aside for examination fee waivers.

A further Sh1 billion has been earmarked for the promotion of 74 teachers and Sh4.9 billion for the school feeding programme.

The security sector has been allocated Sh338.2 billion to support the operations of the Kenya Defence Forces, National Police Service, National Intelligence Service and Prisons Service.

The construction, rehabilitation and maintenance of roads and bridges will take up Sh244.9 billion during the year.

Apart from the increased allocations to their respective funds, youth and women got more to smile about after Treasury allocated money to hire 8,000 interns at Sh25,000 per month each, recruit youth into the National Youth Service and provide free sanitary towels.

In the manufacturing sector, Sh26.9 billion has been allocated to improve local industries and support the establishment of county-integrated agro-industrial zones and the construction of six special export processing zones.

Prof Ndung’u proposed to zero-rate liquefied petroleum gas (LPG), which has been attracting 8 per cent VAT.

President William Ruto and Taifa Gas Group Chairman Rostam Aziz unveil a plaque during the groundbreaking ceremony of the 30, 000 Metric Tons plant at the Dongo Kundu Special Economic Zone in Likoni, Mombasa County on February 24, 2023.

“I am proposing to Parliament to zero-rate VAT on LPG in order to make LPG affordable and promote its uptake as well as encourage the use of clean energy sources,” the CS said.

Exported taxable services

Treasury also proposes to remove VAT on exported taxable services to increase competitiveness and encourage the export of taxable services. Currently, exported services are subject to VAT at the rate of 16 per cent.

Tea purchased from factories or tea auction centres for value addition and subsequent export will also not be subject to VAT.

VAT from all aircraft, simulators for training pilots and aircraft spare parts, inbound international sea freight offered by registered persons and locally purchased machinery and equipment is also set to be removed.

The cost of transferring money is expected to come down Treasury proposed to reduce the excise duty from 20 per cent to 15 per cent on fees charged for telephone and internet data services and on fees charged for money transfer services by banks, money transfer agencies and other financial service providers.

The cost of transferring money is expected to come down Treasury proposed to reduce the excise duty from 20 per cent to 15 per cent on fees charged for telephone and internet data services and on fees charged for money transfer services by banks, money transfer agencies and other financial service providers.

The tax rate on rental income was also reduced from 10 per cent to 7.5 per cent per month.

Workers will enjoy tax relief of 15 per cent on contributions to post-retirement medical funds or Sh5,000 per month, whichever is lower. Exemption from income tax on investment income earned by the post-retirement medical fund is expected to reduce pressure on government spending on medical care and provide retirees with access to dignified healthcare.

"Sweet pain"

On the other hand, sugar consumers are set to experience more pain as the government plans to impose an excise duty of Sh5 per kilogramme of imported sugar, at a time when a shortage of the commodity has driven prices to highs of Sh210 per kilogramme.

Prof Ndung’u said yesterday that the duty, which will be passed on to the final consumer, is meant to discourage the consumption of sugar on health grounds. Sugar is one of the most widely consumed household food products, alongside bread, flour, rice and milk.

A global shortage of sugar has led to a spike in prices to about $675.69 (Sh94,400) per tonne, up from $560.46 (Sh78.301) in February. The Kenyan market is itself facing a shortage that has seen the country’s weekly optimal stock drop by 80 per cent on the back of diminished production by factories and expensive imports, pushing up retail prices to historic highs.

Sugar consumers are set to experience more pain as the government plans to impose an excise duty of Sh5 per kilogramme of imported sugar, at a time when a shortage of the commodity has driven prices to highs of Sh210 per kilogramme.

“Consumption of sugar has been associated with various ailments such as diabetes which has become common in many families,” said Prof Ndung’u.

“To discourage consumption of sugar, I propose to the National Assembly to introduce excise duty on imported sugar at the rate of Sh5 per kilogramme excluding the sugar imported or purchased locally by registered pharmaceutical manufacturers for use in the manufacture of pharmaceutical products,” he added.

The duty would also have applied to local sugar as per the Finance Bill 2023 had the Budget and Finance Committee of the National Assembly not amended the Bill to specify that it would only be applicable to imported products.

Other household staple products such as rice and wheat were however given favourable treatment by the CS in the budget, through lower duty on imports.

Prof Ndung’u said that due to insufficient local production of the two commodities, Kenya will be importing rice at a rate of 35 per cent, instead of the 75 per cent rate agreed under the East African Community (EAC) Common External Tariff.

Wheat imports will also attract a lower duty of 10 per cent instead of the 35 per cent stipulated under the EAC Duty Remission Scheme. The importation of wheat will be undertaken upon the recommendation by the Ministry of Agriculture, which will ensure millers purchase local wheat first, said the CS.

Wheat imports will attract a lower duty of 10 per cent instead of the 35 per cent stipulated under the EAC Duty Remission Scheme.

EAC Finance ministers, in their annual pre-budget consultations, meetings also agreed to extend a raft of special duty measures to support Kenya’s manufacturing sector. These include allowing Kenya to continue importing inputs for the manufacture of baby diapers duty-free for one more year and to continue charging imported diapers duty at 35 per cent for the year to protect local manufacturers.

A similar window for duty-free imports of raw materials and inputs for the manufacture of footwear products and roofing tiles was granted to Kenya. And also for imports of inputs for the manufacture of animal feeds in order to address the high cost of the product that has contributed to high food prices in the country.

Treasury also pushed for the removal of VAT exemption on taxable services provided for the construction of specialised hospitals; goods and services for the construction of tourism facilities; and goods purchased by manufacturers worth more than Sh2 billion.

On advertising revenue, t excise duty at the rate of 15 per cent of the excise value on fees charged for advertisements by all television, print media, billboards and radio stations promoting alcohol, betting, gambling, lottery and prize competitions will be introduced.