Premium

Shocker as KRA refuses to waive Sh36 billion tax arrears owed by sugar millers, cites Finance Act

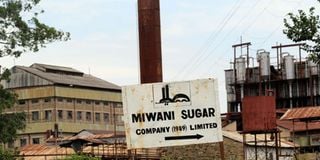

The entrance to Miwani Sugar Factory in Kisumu County. It is one of the five public sugar mills that stood to benefit from a Sh36 billion tax waiver.

The Kenya Revenue Authority (KRA) has said it has no power to write off Sh36.6 billion in tax arrears owed by the five public sugar mills.

While the National Treasury and the Ministry of Agriculture have recommended that the tax collector should waive taxes, penalties and interest to facilitate the restructuring of the indebted companies, KRA Commissioner General Humphrey Wattanga said his hands are tied.

He pointed out that the Finance Act 2023, which came into effect on July 1, 2023, removed the commissioner's power to write off tax debts.

"Previously, Section 89(7) of the Tax Procedure Act provided that the Commissioner may, on the application of a taxpayer or on his own motion, waive in whole or in part any penalty or interest payable by a person," he said.

The Commissioner-General said the remission is possible if the KRA is satisfied that the remission is based on considerations of hardship or equity, or impossibility or undue difficulty or expense in collecting the tax.

He, however, urged the cash-strapped sugar millers to take advantage of the tax amnesty on interest and penalties for periods up to December 31, 2022, as introduced by the Finance Act 2023.

Under the amnesty, which runs from September 1, 2023 to June 30, 2024, a taxpayer is entitled to amnesty on penalties and interest on payment of all outstanding principal taxes due for periods up to December 31, 2022.

“Sugar companies can take advantage of this amnesty by making payment arrangements with KRA to settle their outstanding principal taxes accrued up to December 31, 2022 by June 30, 2024. This will however still leave interest and penalties for the period January 2023 to date outstanding and payable,” he said on Thursday while appearing before National Assembly’s joint committees of Finance and National Planning and that of Agriculture sitting in Kisumu.

To facilitate the leasing of five State-owned sugar mills, National Assembly Finance and Planning Committee Chairperson Kuria Kimani called on the National Treasury to consider settling the amount.

“We need to ensure everything is done the right way as we work towards resuscitating the once-vibrant sector that supports the livelihoods of more than eight million Kenyans,” he said.

He however, raised concerns over the huge disparity in arrears raised by the National Treasury, compared to KRA figures.

According to the Treasury Memorandum on Action Plans to revive and commercialise the State-owned sugar companies, Chemelil, Muhoroni, Miwani, Nzoia and Sony Sugar Company owes KRA penalties and interest estimated at over Sh50 billion.

But Mr Wattanga noted that the inclusion of Mumias Sugar debt puts the figure at Sh36.6 billion.

The report by KRA indicated that Mumias accrued debt is at Sh20.2 billion, Nzoia (Sh7.1 billion), Chemelil (Sh2.7 billion), Muhoroni (Sh3.2 billion) while Sony has Sh3.1 billion arrears.

Sigowet/Soin MP Justice Kemei, however, called for a forensic audit of the figures raised by the National Treasury to ensure taxpayers do not suffer further losses.

A further analysis of the Treasury Memorandum indicated that the five public sugar millers owe cane farmers a total of Sh1.7 billion, salary arrears of Sh5.2 billion, sugar development levy of Sh11.3 billion, government loans Sh54.4 billion and Sh5.2 billion to other creditors.