The Treasury has announced plans to review taxation of workers’ pay to lessen the burden on low-income earners amid rising cost of living and stagnant wages.

Treasury Cabinet Secretary Njuguna Ndung’u says Kenya’s current pay-as-you-earn (Paye) structure has hit the low-income earners hardest, leaving them with little to save or invest, if any.

“The current structure is not progressive since tax bands are not wide enough to cushion low-income earners. Further, the structure increases opportunities for tax avoidance and evasion,” Prof Ndung’u says in the 2024 Budget Policy Statement.

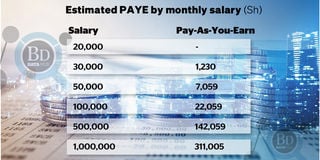

Workers earning a monthly income of less than Sh24,000 have been exempted from taxation since May 2020 following the enforcement of the Tax Laws (Amendment) Act of 2020. That law initially targeted providing temporary relief to workers hardest hit by the Covid-19 pandemic.

Before the changes to the law, such earnings attracted a tax at the rate of 10 percent.

Those with a salary of between Sh24,001 and Sh32,333 pay 25 percent, while those with income from Sh32,334 to Sh500,000 pay 30 percent.

High-income earners with a salary of between Sh500,001 and Sh800,000 are charged PAYE at the rate of 32.5 percent, with taxes rising to 35 percent for payment over and above that level.

The proposed changes to the PAYE structure through an amendment to the Income Tax Act, which could be enforced from the year starting July 2024, will be informed by a study to be conducted by the Kenya Revenue Authority(KRA), the Treasury says.

This comes amidst growing concerns some workers servicing loans are being deducted more than two-thirds of their basic monthly pay on the back of rising living costs, in breach of the Employment Act, 2007.

Those earning Sh50,000 and below have been hit hardest, prompting some of them to rely on mobile loans for basic needs and keeping them in a debt trap.

“When you look at it critically with the rising cost of living in mind, someone earning Sh32,333 being taxed at 30 percent is punitive,” Philip Muema, a partner at Andersen Kenya, a tax and business advisory firm, said in an interview.

“Add to this high tax rate the housing levy of 1.5 percent [suspended by the courts] and the fact that employees cannot claim any expenses against their income, then you find that the effective individual rate of income tax is higher compared to the tax paid by corporates.”

A raft of new and higher taxes this financial year has raised the cost of goods and services, with workers facing a further deduction on payslips to fund President William Ruto’s affordable housing programme.

Employers have particularly been opposed to the housing levy which is deducted at the rate of 1.5 percent of gross pay, which they are required to match.

The levy — declared unconstitutional by the courts but which Dr Ruto is determined to reintroduce through a new law — is a gross-on-gross taxation on workers’ income where the KRA uses the same gross to also calculate the PAYE, hence a form of double taxation.

“The housing levy that is being introduced to Kenyans should also be a deductible expense. That means it should be treated the same way we treat contributions to NSSF and other registered pension schemes from a payroll perspective,” Mr Muema said.

“Further, I think in the spirit of achieving equity and fairness in taxation, employees should be granted rebates for expenses that they incur in generating the employment income such as personal medical costs, rental costs, and transport costs.”

Employees currently pay taxes on wages, salary, sick pay, leave pay, fees, commissions, bonuses, service gratuity, allowances, director’s fees, overtime, pension, entertainment, and any other payments received in respect of employment.

The rising statutory deductions, amid rising interest on loans as the Central Bank of Kenya looks to tame demand-driven inflation, have left employers in a state of confusion.

“Other than the statutory deductions, people have their commitments like loans, mortgages, and fees,” Jacqueline Mugo, the executive director and CEO of the Federation of Kenya Employers (FKE), said in an earlier interview.

“There is a need for the government to harmonise these deduction laws. What do we obey? Do we obey the Employment Act or others like for housing levy and pension? At the end of the day, all these are laws and none supersedes the other except the Constitution.”

Collections from payroll fell short of the Sh312.8 billion target for the half-year period through December 2023 by Sh56.5 billion. This was after the KRA received Sh256.3 billion in that period, an 11.01 percent growth over Sh230.88 billion in the same period last year.