Drug shortage hits county hospitals

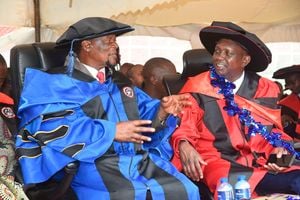

Kemsa Acting Chief Executive Officer Dr Andrew Mutava Mulwa.

What you need to know:

- Machakos County owes Sh122,002,757 and is closely followed by Homa Bay at Sh 104,814,066.

- Kemsa told the Nation that it is engaging the counties over debt.

At least 27 counties lack essential life-saving drugs after the Kenya Medical Supplies Authority (Kemsa) stopped supplying them due to a Sh2.88 billion debt owed by devolved units.

County health facilities are in dire need of a restock of painkillers, antibiotics, antidepressants, anti-cancer and anti-diabetic drugs. Also lacking are medicines needed to perform life-saving surgical procedures such as anaesthesia.

Some of the most affected counties are Nairobi, Mombasa, Homa Bay, Kakamega, Nyamira, Trans Nzoia, Nakuru, Busia, Kisumu, Tana River, Kilifi, Kwale, Garissa, Murang’a, Meru, West Pokot, Samburu, Turkana, Marsabit, Mandera, Migori, Kiambu, Isiolo, Kwale, Vihiga, Taita-Taveta and Tharaka-Nithi.

In an exclusive interview, Kemsa Chief Executive Officer Dr Andrew Mulwa said that all 47 counties owe the medical supplies agency a total of Sh2.88 billion as of May 29.

Kemsa gets 90 percent of its business from counties where it supplies drugs, medicines and medical equipment. It gives the counties a 45-day credit period.

“We are stocked up to 70 per cent. You can come and visit us. I will give you the tour myself,” the CEO said in a telephone interview, suggesting that the problem was not on the agency’s side, but the counties that had not paid their debts.

Debt

“The Sh2.88 billion debt has hampered Kemsa’s ability to restock essential medical supplies,” said the authority.

Kemsa told the Nation that it is engaging the counties over debt.

“We have had negotiations with counties and they have provided Kemsa with payment plans. We are in constant communication with Council of Governors, as well as county ministers of Health and Finance. We are also in meetings with senators with a view to unlock payments,” he said, adding that the authority has sought the support of the National Treasury for capitation.

In September last year, Dr Mulwa said he does not consider arrears accumulated by counties to be bad debts because eight counties that had not paid then showed a willingness to settle the debt.

Counties that default for more than 120 days, Dr Mulwa said, cripple the operations of Kemsa.

Of the counties with most debt, Kilifi leads with Sh275,695,597, followed by Nairobi at Sh 243,797,432 while Kakamega County follows with Sh 182,088,552.

Tharaka-Nithi County whose governor, Muthomi Njuki, is the chair of the Council of GovernorHealth Committee, owes Kemsa Sh180,063,569.

Machakos County owes Sh122,002,757 and is closely followed by Homa Bay at Sh 104,814,066.

The two best performers that have almost completed paying their debts are Makueni and Wajir counties. Makueni County owes the authority Sh74,879 while Wajir is left with Sh195,323 to clear her debt.

The latest official data from Kemsa dated May 29 shows that Baringo County is supposed to pay Sh50,466,192, Bomet Sh64,744,565, Bungoma Sh 44,085,314, and Busia Sh 71,136,436.

Others are Elgeyo Marakwet Sh 82,432,196, Embu Sh91,619,141, Garissa Sh82,732,350, Isiolo Sh 42,057969, Kajiado Sh93,556,174, Kericho Sh 6,638,140, Kiambu Sh2,061,390 and Kirinyaga Sh 50,141,806.

Kisii county owes Kemsa Sh36,021,348, Kisumu Sh 11,643,633, Kitui Sh13,938,095, Kwale Sh67,859927, Laikipia Sh 62,705,138 and Lamu Sh 23,367,503.

Mandera owes the agency Sh82,938,736, Marsabit Sh50,609,107, Meru Sh 85,344,071, Migori Sh54,612,600, Mombasa Sh7,313,099, Murang’a Sh19,080,420, Nakuru Sh58,351,897, Nandi Sh47,183,570, Narok Sh 78,168,500 and Nyamira Sh 39,132,229.

Others are Nyandarua Sh 24,536,262, Nyeri Sh38,980,714, Samburu Sh50,618,265, Siaya Sh61,024,588, Tana River Sh37,167,354, Trans Nzoia Sh49,314,858, Turkana Sh65,869,801, Uasin Gishu Sh58,928,154, Vihiga Sh94,426,701 and West Pokot Sh 48,565,617.

“My son fell ill this morning. When we took him to Makongeni dispensary in Thika town, we were told that almost all the medication they needed to treat him was out of stock,” Mary Wambui, a businesswoman, told Nation on Wednesday, May 29, 2024.

She had to take a loan on M-Shwari for her son to be treated at a private hospital.

At Mbagathi Hospital, many patients crowded at the health facility’s reception.