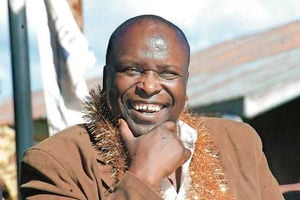

Equity Group Managing Director and CEO James Mwangi during an interview at his office after the bank's investor briefing and release of Q1 2025 Financial Results at Equity Centre, Upper Hill, Nairobi on May 29, 2025.

Kenya’s real estate market was last Thursday rocked by a dramatic legal battle over a prime four-acre parcel in Muthaiga, pitting Equity Bank CEO James Mwangi against property firm Mount Pleasant Limited, with former President Daniel Moi and ex-Finance Minister Arthur Magugu also sucked into the dispute.

The contested land, valued at Sh1 billion, consists of two parcels—L.R. 214/20/1/1 (0.733 acres) and L.R. 214/20/2 (3.037 acres)—originally amalgamated as L.R. 204/832.

The property’s history dates back to 1915, when colonial settler James Archibald Morrison owned it before passing through several hands, including British aristocrat Ferdinand Bentinck, who sold it to then-President Moi in 1980.

According to the court papers, following his acquisition of the properties, Moi mortgaged the assets to Standard Bank Limited to secure an overdraft facility of Sh3.1 million the same year.

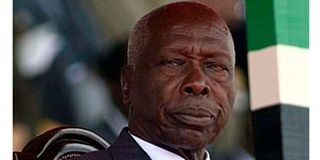

Late President Daniel arap Moi.

In April 1982, Moi transferred the two parcels totalling approximately four acres to his Cabinet Minister for Finance, Arthur Magugu, and his wife, Margaret Wairimu, for Sh3 million, a transaction registered simultaneously with the discharge of a mortgage Moi had taken with Standard Bank.

The Magugus later mortgaged the property to the National Bank of Kenya in July 1987 and June 1988 to secure a repayment of a financial facility of Sh8 million and Sh2.5 million, respectively, advanced by the bank to a third party known as MDC Limited.

It is alleged that MDC Limited, the borrower of the loan facility, defaulted in repayment of the facilities, causing the bank to begin recovery of the debts through a 2002 court consent allowing a private sale.

A company known as Mount Pleasant Limited purchased the land in 2006 at Sh130 million, paying Sh90 million to the National Bank of Kenya and Sh27 million to the Magugus.

The transaction took place between July 2006 and September 2007.

The company subsequently took possession, demolished existing structures, and began planning an upscale development in one of Nairobi's most exclusive neighbourhoods.

But trouble began brewing in 2010 when other claimants started appearing at the property.

First came John Birech in 2013, presenting forged documents, including two certificates of postal search, showing that Moi was the alleged owner of the properties.

This led to his arrest and prosecution at a Milimani magistrate's court with four counts of forging and uttering a document of land title and uttering a false statement.

Mount Pleasant also filed a civil case at the Environment and Lands Court against Mr Birech, who stated that he was no longer in possession of the properties and had no continuing interest in them, and consequently, it withdrew the suit

Equity Group Managing Director and CEO James Mwangi during an interview at his office after the bank's investor briefing and release of Q1 2025 Financial Results at Equity Centre, Upper Hill, Nairobi on May 29, 2025.

Then entered Equity Bank's James Mwangi and his spouse, claiming they had purchased the same land directly from former President Moi in 2012 for Sh320.6 million, a figure the Mount Pleasant argued was below market rates. With him was a conveyance allegedly signed by Moi on February 20, 2012.

Mr Mwangi’s legal team maintained they conducted due diligence, secured Moi’s blessing, and took possession of the property in 2013.

He testified that in December 2012, he entered into an agreement with then-President Moi for the purchase of the property and that prior to execution, they conducted a search, verified all the details, and carried out a valuation.

Read: Mudavadi stepmother's estate cleared in land dispute as court awards families Sh11.2m for demolition

In his counterclaim, he stated that all requisite payments in the land transaction were made through their advocates, beginning with a deposit of Sh32 million. They duly paid the applicable stamp duty of Sh12.8 million and, upon registration of the conveyance, settled the outstanding balance of the purchase price.

The sale agreement was executed between Moi on one hand and Muthaiga Luxury Homes on the other, although the cover page states that the agreement is between the former President and himself. The retired president died in 2020.

The businessman said by April 2013, the sale agreement had been completed and that he applied for consolidation of the two parcels, which was granted and the same were amalgamated. With the County approval, he constructed a boundary wall.

Upon completion of the transaction and the handover of possession, their advocate, together with Mr Mwangi, visited the former President to formally, albeit informally, confirm that the sale of the properties had been successfully concluded.

They immediately took possession and instituted strict security measures, including engaging the services of a private security firm to guard the premises.

Testifying in court, Mr Mwangi recalled meeting the former President at his home in Kabarnet Garden, Nairobi, where the former President personally blessed him with the land.

Thereafter, the agents took him to the property, which at the time was covered with mature trees and bushes, he narrated. He emphasised that the property holds deep sentimental value, describing it as a privilege to have acquired it directly from the former President.

Mr Mwangi stated that the land was not intended for commercial development but for the construction of a family home. He further explained that the purchase of the land was a special gift to his wife in commemoration of their 25th wedding anniversary.

However, their employees later reported that an individual had laid claim to ownership of the property, and that upon investigations, it was established that he was acting as an agent/ employee of Amin Manji, a director of Mount Pleasant.

It was their defence that they are perplexed by Mount Pleasant's contradictory position in simultaneously pleading adverse possession while also asserting that the Magugu purchased the suit properties from the former President.

Former Cabinet minister Arthur Magugu who died on September 15, 2012. Photo/FILE

They maintained that the Magugu’s lacked any documentary evidence of ownership, which could have enabled them to transfer the properties to the Plaintiff.

However, Mount Pleasant countered that Moi had no legal interest left to sell after the 1982 transfer to Magugu. Mount Pleasant argued that Mr Mwangi's claim of ownership was inconceivable, given that the former president’s title to the suit properties was fully extinguished in 1982 when they were conveyed to the Magugu family.

"All registered transactions relating to the properties between 1982 and 2007 inexplicably disappeared from the records. It is implausible that a sitting Head of State, with significant control over government affairs, could have been unaware that his own properties were allegedly irregularly taken over by his then Minister for Finance, Mr Magugu," it stated in court.

The estates of the late President Moi and Magugu were not parties to this court case.

The competing claims sparked a bitter legal battle initiated by Mount Pleasant Ltd in 2020, culminating in a 93-page judgment delivered on October 23, 2025, by the Environment and Lands Court in Nairobi.

The court found Mount Pleasant's ownership legitimate while declaring Mr Mwangi's title "null and void ab initio (from the beginning)."

While meticulously tracing the property's history from its 1915 Crown allocation through successive owners until the Magugu transaction, the court upheld Mount Pleasant’s documented trail—from Moi’s 1982 sale to Magugu, the National Bank of Kenya mortgage, and the 2006 purchase—supported by conveyances, bank records, and testimony from Magugu’s widow.

"The Magugus' ownership was corroborated by independent third parties including NBK and their lawyers," the court noted, dismissing claims the documents were forged.

The court identified multiple irregularities in Mr Mwangi's claim. For instance, the court noted that Moi had already transferred the property in 1982 - he could not sell what he did not own.

The court invoked the legal maxim "no one gives what they don’t have", ruling that the alleged Moi’s 2012 sale was void since he had already transferred ownership three decades prior.

"Once Moi conveyed to Magugu, no residual interest remained capable of lawful transfer.," the trial judge ruled.

The judge flagged irregularities in Mr Mwangi’s title, including unsigned registry entries, inconsistent file references, and discrepancies in amalgamation documents. Forensic analysis of signatures, though inconclusive, failed to outweigh Mount Pleasant’s evidence.

Also noted were documentary anomalies. The court found that Mr Mwangi's conveyance cited incorrect file numbers (File 6090 belonged to a different property, LR 2/300) and contained unsigned registry entries.

Another key finding concerned missing land records. The Chief Land Registrar admitted key registers were untraceable but confirmed Mount Pleasant’s version using surviving deed files.

Equity Group Managing Director and CEO James Mwangi during the interview at his office in Nairobi on March 27, 2025.

Notably, Mr Mwangi’s lawyers conceded they never inspected the original records before purchase.

In regard to due diligence, the lawyers admitted they never conducted official searches before the purchase.

"The alarming aspect of this dispute was the fact that the advocates who represented the first and second defendants in the purchase of the land did not present to this court an official search that was conducted before they commenced the transaction in 2012, a critical misstep on their part," said the court.

"No innocent purchaser would buy prime land without verifying title," the court remarked.

The court ruled that in the absence of an official search, which would have revealed whether indeed the former President was the registered owner of the land in 2012 or not, renders Mr Mwangi's plea of being innocent purchasers for value unsustainable.

Further, the court highlighted the suspicious timing of the transaction. The court noted that the alleged sale occurred shortly after Mount Pleasant's title documents mysteriously disappeared from land registry files.

The procedural and documentary irregularities surrounding Mr Mwangi's title led the court to impeach it compared to the evidence tables by Mount Pleasant.

The defendants' attempt to discredit Mount Pleasant's documents through forensic analysis backfired.

This is after the examiner admitted working with photocopies rather than originals and lacking access to standard forensic tools like Video Spectral Comparators or Electrostatic Detection Apparatus, which are essential for detailed examination of ink variations and document impressions.

"In light of these considerations, the court finds that the forensic evidence presented by DW2 does not dislodge the documentary, transactional, and testimonial evidence supporting the 1982 conveyance between the former President Moi and the Magugus," the court ruled.

"Taken together, these materials establish a coherent and credible chain of ownership. Accordingly, the court is persuaded that the Magugus’ ownership has not been impeached," it concluded.

The court ordered immediate cancellation of Mr Mwangi's title, his eviction within 30 days and payment of Sh10 million damages for trespass.

Police were directed to provide assistance in enforcing the orders.

The Registrar of Lands was also directed to restore Mount Pleasant’s ownership records.

The case underscores systemic vulnerabilities in Kenya’s land registry, where missing files and unsigned entries enabled competing claims.

It also highlights risks for high-profile buyers, with the trial judge Oscar Angote noting Mr Mwangi’s legal team failed to verify the alleged Moi’s ownership before transacting, despite red flags like the absence of an original sale agreement.

While the judgment resolves the civil case, it leaves open questions about potential criminal culpability.

The Directorate of Criminal Investigations had flagged suspected forgery of documents, but probes were stalled by court orders.

As Kenya continues grappling with land fraud cases, this saga serves as a cautionary tale about the importance of meticulous documentation and the perils of Kenya's chaotic land administration system, where, as Justice Angote observed, "the treasured title deed has increasingly become worthless paper."

Follow our WhatsApp channel for breaking news updates and more stories like this.