Premium

SRC goes for civil servants' hefty allowances

A report by the Salaries and Remuneration Commission notes that there are 149 allowances payable in the public service today. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

What you need to know:

- The SRC wants only the relevant allowances to be consolidated in the basic salary structure, away from the current scenario where some civil servants live off allowances.

- For instance, while junior civil servants only take home about Sh3,000 per month as house allowance, senior employees earn in excess of Sh150,000 per month.

- The SRC wants perks whose economic value or rate is not commensurate with the intended purpose restructured.

Public servants will lose several allowances paid to them, in a shock move by the Salaries and Remuneration Commission that targets their perks, and which has the potential of heavily affecting household budgets.

Likely to be worst hit are senior government officials who enjoy layers upon layers of allowances, some much higher than their basic salaries.

While the cream of these allowances is enjoyed by the top civil servants, a number of them are spread across all job cadres and are the driver of the government’s wage bill crisis, currently at Sh730 billion.

Kenya spends one in every two shillings it collects in taxes to pay its public employees.

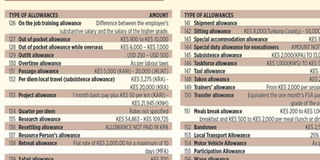

A report by the Salaries and Remuneration Commission (SRC) notes that there are 149 allowances payable in the public service today, which cunning civil servants are exploiting at the expense of the taxpayer. Of these, 90 are remunerative while 59 are facilitative.

CONSOLIDATE PERKS

As a result, the SRC wants only the relevant allowances to be consolidated in the basic salary structure, away from the current scenario where some civil servants live off allowances.

The commission’s chairperson, Ms Lyn Mengich, says some allowances need to be either renamed and merged, restructured, retained and harmonised, or reviewed to determine purpose of payment.

“Despite various initiatives taken to rationalise allowances in the public service, they have continued to increase significantly in terms of numbers and amount relative to salaries,” Ms Mengich told the Nation on Wednesday.

“Allowances have been used to increase remuneration by various public service organisations, thus acting as a major component of the compensation package,” she added.

The effect of this rally has been two-fold: It has created inequity and unfairness within and across public service organisations, and has also been a basis for requests for parity of treatment among cadres performing similar jobs under similar circumstances.

Salaries and Remuneration Commission chairperson Lyn Mengich says some allowances need to be reviewed to determine purpose of payment. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

WAY FORWARD

The SRC says it will deal with the allowance headache in two phases: by first reviewing four allowances — namely house allowance, hardship allowance, leave allowance, and subsistence allowance — and then updating the list of grants and engaging stakeholders before final implementation of the recommendations.

To put the crisis into perspective, the Nation studied a report by audit firm Deloitte that formed the basis of the end-term report by the previous commission, and which showed how important — or painful, depending on whose side one is — allowances have become within the civil service.

For instance, one cadre whose average basic pay was Sh32,367 ended up getting a mean gross salary of Sh158,487 after allowances.

That means employees earned Sh126,120, or 80 per cent of their total monthly pay in allowances.

A summary of all employees across job groups showed that on average, between 65 per cent and 85 per cent of their take-home was just allowances.

DISPARITIES

This means some of the best-paid civil servants take home nearly five times their basic pay in allowances.

The most experienced at claiming these allowances earned as much as 95 per cent of their total pay in these stipends.

Even for the internationally acceptable allowances, Kenya has some of the most handsome perks for its top civil servants.

Even for the internationally acceptable allowances, Kenya has some of the most handsome perks for its top civil servants. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

However, disparities among various institutions within the same government have led to the abuse of this provision.

For instance, while junior civil servants only take home about Sh3,000 per month as house allowance, senior employees earn in excess of Sh150,000 per month, beating many of their colleagues in the private sector.

Employees of the Parliamentary Service Group were the highest earners, followed by state corporations and the judicial service, the report by Deloitte noted. Teachers, meanwhile, earn the lowest amount of allowances.

ABUSE

Officers at policy level claim between Sh60,000 and Sh100,000 per month as extraneous allowances.

However, their juniors who qualify for this allowance earn between Sh800 and 15,000 per month.

The study says some staff in Parliament, who receive this allowance, are also eligible for responsibility allowance, creating an avenue for overlap of payment and making the allowance prone to abuse.

The SRC now wants allowances that are paid for similar purposes but have different names merged, and those whose rationale is redundant or the purpose overlaps with that of the basic salary abolished.

For responsibility allowance, those who qualify get between Sh10,000 and Sh76,000 on average, whereas entertainment allowance is between Sh20,000 and 100,000.

Some of the allowances do not exist even among the best-paying companies in the private sector. Others are redundant, while many more overlap with the basic salary. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

REDUNDANT

Commuter and transport allowance ranges between Sh802 and Sh75,600 per month. Members of Parliament get more in mileage claims.

Other allowances include non-practice allowance (Sh15,000 to Sh60,000), hardship allowance (Sh600 to Sh13,000), risk allowance (Sh7,000 to Sh16,000), medical allowance (Sh375 to 2,490), annual leave allowance (Sh4,000 to Sh50,000) and domestic servant allowance (Sh15,600 to Sh30,000).

County bosses enjoy a governors’ allowance of Sh84,000 while their deputies get Sh64,000.

Parliament has special parliamentary duty allowances that range from Sh78,000 to Sh150,000

Some of the allowances do not exist even among the best-paying companies in the private sector. Others are redundant, while many more overlap with the basic salary.

This means that staff are paid allowances for doing what they were recruited to do, and for which they earn a basic salary.

DUPLICATION

Some of the duplicating allowances include the special duty allowance, which is paid to an officer called upon to perform duties of a higher post, but does not possess the necessary qualifications for appointment to that post.

It is expected that that should be covered by the acting allowance, which also exists on the allowances list.

Then there is the responsibility allowance, which is paid to officers whose duties involve added responsibility over and above the normal duties of officers of equivalent rank, and for which regular salary is assigned.

Some of the duplicating allowances include the special duty allowance, which is paid to an officer called upon to perform duties of a higher post. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

Besides the house allowance, personal aide allowance (meant to facilitate public servants using wheelchairs and the visually challenged to pay for their guides), and commuter allowance, there is another layer of allowances that, if exploited well, could turn civil servants into millionaires.

Other allowances include extraneous, hardship, health, and risk grants, which are split, despite addressing difficulties at work.

Making them separate has opened a window where they are as varied as the departments in government are.

AUDIT CHALLENGES

A telephone allowance, for instance, is paid to officers to facilitate communication on official duties, and the SRC report says the amount depends on job groups and is paid either through the payroll or airtime scratch cards.

Some parastatal employees, such as those working for the National Housing Corporation, Kenya Power and Kenya Ports Authority, enjoy some unique allowances, including the bicycle allowance that has now been scrapped, and the Greater Duty and Third Shift allowances.

The SRC wants perks whose economic value or rate is not commensurate with the intended purpose restructured, and those whose purpose of payment is still valid retained but harmonised.

“In the absence of data, and the fact that the payroll is not integrated and some of the allowances are paid through vouchers, it is difficult to ascertain the amounts being paid,” the commission notes.

The end-term report of the previous commission had noted that although the remunerative allowances are paid and can be tracked through the payroll, quantifying all facilitative payments in the public service was a challenge.

“Some of the facilitative allowances are lumped together with other budget line items such as training and workshop, making it difficult to analyse, budget and report them separately. This creates a gap in audit trail,” SRC noted.

Other allowances include extraneous, hardship, health, and risk grants, which are split, despite addressing difficulties at work. ILLUSTRATIONS | MICHAEL MOSOTA | NATION MEDIA GROUP

POLICE OFFICERS

Judicial officers, nurses and nutrition officers, among other government cadre, draw an allowance for various uniforms and robes. For judicial officers, the allowance is known as the robe allowance.

But this allowance is not just a preserve of those who are required to wear uniforms at work.

A plainclothes allowance is paid to all police officers who are required to wear uniform, but due to their special assignment wear civilian clothing.

Officers handling horses and dogs are paid an animal handlers’ allowance to compensate them for the training, risks and strain involved as they handle the animals in their course of duty.

Police officers in the air wing involved in the repair and servicing of aircraft earn an aircraft engineering allowance, while those deployed as pilots earn a police pilot allowance.

PRESIDENTIAL ESCORT

A coxswain allowance is paid to water police officers and livestock and fisheries officers who are deployed in marine duties to compensate them for working long hours in unusual and risky environments.

Being on the presidential escort team is one of the most sought-after jobs for police officers, as it attracts the presidential escort allowance.

This allowance is paid to officers deployed from the police service who form the security network of the President and accompany him to functions.

“The allowance is compensation for the extraneous nature of the duties as they are expected to be on call and alert at all times, and have undefined duties that go beyond normal working hours,” the SRC says in its report.

Related to this allowance is the VIP protection allowance, which is paid to officers deployed from the police service, and who form the security network of VIPs.