Vendors sell their merchandises at Bus Station in Nairobi on June 10, 2021.

| Dennis Onsongo | Nation Media GroupNews

Premium

Ukur Yatani’s budget a balance of debt and hope for Kenyans

What you need to know:

- Shackled by outsized debt repayment obligations and a projection of modest tax revenue growth, Mr Yatani took the practical approach and presented a measured Sh3.6 trillion expenditure plan.

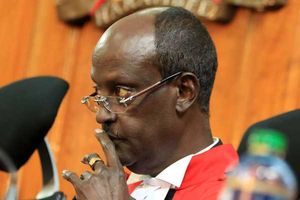

Treasury Cabinet Secretary Ukur Yatani on Thursday presented a restrained budget that aims to jump-start the Covid-19 ravaged economy, while avoiding the expansionary bend that has been the hallmark of the Jubilee administration.

Shackled by outsized debt repayment obligations and a projection of modest tax revenue growth, Mr Yatani took the practical approach and presented a measured Sh3.6 trillion expenditure plan, with the hope that economic recovery will provide headroom for more radical policy shifts in the future.

“Pressing concerns raised by Kenyans during the consultation process revolved around the impact of Covid-19 and its containment measures. Kenyans were concerned about the high cost of Covid-19 treatment and availability of vaccines in addition to food security, high cost of living and unemployment levels among the youth,” said CS Yatani in his opening remarks.

The budget, which comes into force on July 1, was devoid of the usual grandiose public projects, appearing focused on the challenges paused by the Covid-19 pandemic, education, President Uhuru Kenyatta’s Big Four Agenda projects as well the usual big spenders such as security and infrastructure.

In offering payroll relief to NHIF contributors, the Treasury boss added a few shillings to workers’ pockets, but appeared to take them away by loading new taxes on bread and cooking gas.

Employers who sign up Technical and Vocational Education and Training (TVET) graduates for apprenticeship will enjoy tax rebates, while steel manufacturers will be cushioned as import duty for finished iron and steel products will be retained at 25 per cent.

Treasury Cabinet Secretary Ukur Yatani is pictured with the briefcase containing the 2021/22 budget statement after arriving at Parliament buildings on June 10, 2021.

Budget deficit

Mr Yatani plans to borrow Sh929 billion to plug the 2021/22 budget deficit, even as he is faced with Sh1.16 trillion loan repayment obligations. This means that a third of the budget will be consumed by public debt. (See next page).

Taxes, grants and fees will fund the rest of the budget.

“The major thrust of the tax proposals seems to be administration and seeking to put a damper on tax avoidance, particularly in respect of cross-border transactions,” said Nikhil Hira, a tax expert and director at Bowmans Kenya.

He added: “The general expectation was that we would see some major tax increases in view of the renewed support from international financial institutions… fortunately for the taxpayer, it could have been much worse.”

Import duty on leather and footwear products was also retained at 25 per cent, to cushion local manufacturers. The CS also cushioned local textile manufacturing by keeping the duty for inputs in the sector at zero per cent, under the Duty Remission Scheme. Imported furniture will now attarct 35 per cent duty, a big win for Kenyan carpenters.

Manufacturers of baby diapers will enjoy tax reliefs on import of raw materials, while health products and technologies will be exempt from Value Added Tax (VAT).

Materials used in geothermal, oil and mining projects were also exempted from VAT, as well as equipment for generation of solar and wind energy.

Members of the public, among them Stanley Omondi who is carrying a plate of ugali, ask Treasury CS Ukur Yatani to reduce the price of maize flour ahead of his presentation of the 2021/22 budget statement on June 10, 2021

The pinch

Suppliers of Internet data purchased in bulk for resale will also be smiling after they were given rebates on excise duty.

Mr Yatani also scrapped excise duty on imported glass bottles to discourage use of plastic bottles.

Those set to feel the pinch of the new tax bill are boda boda operators after the CS changed the excise duty rate on motorcycles from Sh11,608.23 per unit to a flat rate of 15 per cent. He also hit nicotine pouches with a Sh5,000 tax per kg and reintroduced excise duty on betting at 20 per cent on amount wagered.

Kenya has entered into a 38-month International Monetary Fund (IMF) loan programme under the Extended Credit Facility and Extended Fund Facility for Sh257 bn ($2.4 bn).

This means the budget has to be in line with certain prescribed fiscal and monetary performance benchmarks, including specific targets on the fiscal deficit, tax revenue, stock of Central Bank net international reserves and public debt.

As part of the IMF benchmarks, reforms are expected under tax administration, procurement processes, public wage bill, restructuring of state owned enterprises (SOEs) and rationalisation of public investment projects.

Mr Yatani said he had factored Kenyans’ concerns while drawing up the budget.

“In addition, Kenyans raised concerns about the general levels of poverty and inequality as well as the increased public debt,” he said. The CS said he would be presenting a request to Parliament to increase the debt ceiling soon.

Big four

In November 2020, Parliament amended the regulations to change the public debt limit from 50 per cent of the Gross Domestic Product (GDP) in net present value to a ceiling of Sh9 trillion.

The ceiling was to last up to 2024. However, with a deficit of Sh952 billion in the 2021/22 budget, the only way not to violate the law is to amend it to provide room for more borrowing.

Mr Yatani allocated Sh20.5 billion to supporting manufacturing for job creation, Sh60 billion for enhancing food and nutrition while the universal health coverage got Sh47.7 billion.

He set aside Sh13.9 billion for affordable housing while the economic recovery strategy got Sh23.1 billion. Sh302 billion was allocated to enhance security while infrastructure got Sh310.7 billion.

Equity, poverty reduction and social protection for vulnerable groups was allocated Sh103.4 billion.

MPs John Mbadi (Suba South), David Ochieng (Ugenya), Ndindi Nyoro (Kiharu), Dr Chris Wamalwa (Kiminini) and Godfrey Osotsi termed the budget statement as “usual rituals to pay debts.”

“For a very long time we have been passing budgets to pay debts and this one is not an exception,” said Mr Mbadi.

“This has become a common occurrence. We pass a budget not to benefit the common person but to pay for money that has been borrowed and stolen by individuals in government,” said Mr Ochieng. “We are in a hole and we continue to dig the hole. It does not add up,” the Ugenya MP added in regard to capital projects.

Members of Parliament listen as Treasury Cabinet Secretary Ukur Yatani presents the 2021/22 budget statement in the National Assembly on June 10, 2021.

Recovery

Dr Wamalwa said the allocation of Sh142 billion to the Big Four Jubilee legacy projects does not reflect a recovery budget.

“If the government ever implemented the previous budgets fully, we would not be in the current state of affairs. We would not be borrowing to pay salaries,” Dr Wamalwa noted.

According to Mr Nyoro, Kenya’s economy is in the intensive care unit (ICU) and will require a miracle to resuscitate it if the borrowing spree continues.

“This country is in the same position Greece was a couple of years back. We have absorbed debts that we can no longer pay,” Mr Nyoro noted.

“It is nothing but a budget to pay debts. Every child born today already has a debt burden of Sh250,000. We have taken more debts than our wealth,” the Kiharu MP added.

Mr Osotsi was apprehensive that the budget will not spur economic growth due to the amounts the government will spend on servicing public debts and salaries.

“It’s also nauseating that in times of the pandemic we can afford a very ambitious budget. How do we finance it without overtaxing the already tax-burdened Kenyans?” posed Mr Osotsi.