Standard Investment Bank marks 30 years of Kenyan excellence

Sponsored by Standard Investment Bank

Standard Investment Bank founder Mr James Wangunyu.

What you need to know:

- In just thirty years, SIB has established itself as one of Kenya’s most respected financial institutions – a leader in multi-asset investing, a champion of Shariah-compliant wealth solutions, and a driver of innovation in African capital markets.

In 1995, a determined banker named James Wangunyu stepped into a modest office at Rehani House with five staff members, a single phone line, and an unshakeable belief that Kenya deserved an investment institution built on integrity, professionalism, and African ingenuity.

That small team would grow into what is today Standard Investment Bank (SIB) – a fully-fledged investment bank with over 250 employees, offices in Nairobi and Mombasa, more than 100,000 equities clients, and over 50,000 investors across its flagship Mansa-X Funds.

In just thirty years, SIB has established itself as one of Kenya’s most respected financial institutions — a leader in multi-asset investing, a champion of Shariah-compliant wealth solutions, and a driver of innovation in African capital markets. Over this period, the firm has also been instrumental in shaping Kenya’s corporate finance landscape, executing more than 60 transactions valued at over Ksh270 billion; and a mainstay in the fixed income space, trading government securities worth more than Ksh2.56 trillion since inception.

A vision born in a small office

Kenya’s financial markets were still emerging in the mid-1990s – largely manual, underserved, and misunderstood. But James Wangunyu saw opportunity where others saw limitations. He founded Standard Stocks, the precursor to SIB, with three founding principles: Integrity before ambition; world-class service for every Kenyan investor; and discipline and transparency as the foundation of trust.

Mr James Wangunyu at his Rehani House office in Nairobi, in 1998.

By the year 2000, Standard Stocks was trading the largest volume of stocks in Kenya, earning recognition as the Best Performing Stock Broker and the Best Investment Bank by the prestigious Think Business Awards, provingthat ethical leadership and client trust could outperform even the largest competitors.

Becoming Standard Investment Bank

In 2003, Standard Stocks acquired the Capital Markets Authority (CMA) Investment Banking Licence, officially transforming into Standard Investment Bank (SIB).

This marked the beginning of an era characterised by bold market leadership and major contributions to Kenya’s capital markets.

Over the next decade, SIB’s Corporate Finance division advised on more than 60 landmark transactions, including: The KenGen IPO, Kenya Re IPO, Family Bank and DTB Rights Issues, Kenya Airways Rights Issue, the NSE Demutualisation and IPO, and the Co-operative Bank IPO, among many others.

These transactions have helped shape Kenya’s and East Africa’s modern financial market structure and positioned SIB as a trusted advisor in both public and private sector capital raising.

Mansa-X: African heritage meets modern investing

In December 2018 SIB acquired the Money Manager License from the Capital Markets Authority, following the enactment of the Online Forex Trading Regulations 2017. The Mansa-X Fund was then launched in 2019, a pioneering multi-asset strategy fund inspired by the legacy of Mansa Musa – the 14th-century emperor celebrated for his disciplined trade networks, expansive economic influence, and unmatched stewardship of wealth. Built on the belief that African excellence can shape modern investment solutions, Mansa-X opened the door for local investors to access globally diversified portfolios managed with local expertise.

The Fund was initially launched as a Ksh-denominated strategy. However, as its reputation grew, so did demand from a new segment of investors – particularly the Kenyan diaspora and local clients seeking to deploy their USD reserves without the need to convert them into Kenya Shillings. In response, SIB introduced the Mansa-X USD variant in October 2022, expanding access and cementing Mansa-X as a truly multi-currency, multi-asset solution.

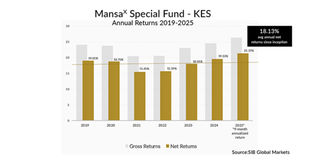

Mansa-X has over the years delivered consistent alpha returns to investors even amidst turbulent markets. Since inception, the fund boasts an Average Net Return of 18.13 percent which outperforms most other local investment options. Mansa-X USD on the other hand has achieved an Average Net Return of 12.53 percent since its inception setting it apart from its peers.

It is this performance that earned SIB the distinction of Best Hedge Fund Manager – Kenya on numerous occasions.

SIB Najah & Mansa-X Shariah: Opening doors for faith-based investors

As investor needs evolved, SIB recognised the importance of offering ethical, faith-aligned investment solutions. In 2023, the firm launched SIB Najah, its Islamic investment banking division and introduced the Mansa-X Shariah Special Fund in both Ksh and USD denominations.

Today Mansa-X Shariah is the largest Shariah-compliant investment solution in Kenya, managing over Ksh3 billion in assets.

This milestone has opened doors for thousands of Muslim and ethical investors seeking professionally managed, globally diversified portfolios that align with their values.

SIB Najah represents SIB’s commitment to inclusive wealth creation, ensuring that no community is left behind.

Transition to the Standard Investment Trust Funds

In 2024, the Mansa-X Fund (Ksh and USD) and the Mansa-X Shariah Fund (Ksh and USD) were transitioned into the Mansa-X Special Fund (Ksh and USD) and the Mansa-X Shariah Special Fund (Ksh and USD) under the umbrella of the Standard Investment Trust Funds. This followed SIB’s successful acquisition of the Special Collective Investment Schemes Licence from the Capital Markets Authority. This milestone empowered the funds to manage larger pools of investor capital while qualifying them for applicable tax incentives.

Today, the Standard Investment Trust Funds (Mansa-X Special Funds) serves over 50,000 investors and manages more than Ksh110 billion, making it one of East Africa’s largest and most trusted alternative investment products. Indeed, as per the Capital Markets Authority Collective Investment Schemes report for Q3 2025, the Standard Investment Trust Funds ranked as the 2nd Largest Collective Investment Scheme in Kenya and the Largest Special Collective Investment Scheme in Kenya by Assets Under Management.

FourFront Management: Powering the future of market innovation at SIB

SIB further expanded its innovation footprint in 2019 with the establishment of FourFront Management – the firm’s technology and digital-solutions division. FourFront was created to design, test and deploy advanced trading infrastructure for the Nairobi Securities Exchange, reinforcing SIB’s commitment to market modernisation. As Kenya’s first and only licensed Robo-Advisor, FourFront delivers international-grade capabilities to both retail and professional traders, enhancing opportunity targeting, trading speed and the consistency of returns. Its innovations range from algorithm-driven actionable insights to securities-lending market-structure tools, proprietary quantitative strategies and trading-capital efficiency solutions – all integral to SIB’s ongoing mission to elevate the standards of Kenya’s investment landscape.

Strategic Partnerships with key industry players

SIB’s journey of expansion and innovation continued in 2024 with a landmark partnership with Safaricom PLC as Fund Manager for the Ziidi Money Market Fund (MMF). Offered through the M-PESA App and USSD. Ziidi MMF enables millions of Kenyans to invest from as little as Ksh100 and earn daily interest – making formal investment accessible to low and mid-income earners across the country. Since its public launch, Ziidi MMF has grown to over Ksh12.6 billion in assets under management.

SIB marked another major milestone in its growth journey in 2024 when it received approval from the Retirement Benefits Authority to begin managing pension funds. This development opened a new frontier for the firm, enabling it to extend its investment expertise to long-term savings and retirement planning. Shortly thereafter, SIB entered into a strategic partnership with the Taifa Pension Fund as its appointed fund manager.

Taifa Pension Fund, an umbrella pension scheme for employers, is a defined-contribution plan administered by CPF Financial Services – Kenya’s largest pension administrator. The Fund accepts NSSF Tier II contributions and offers a wide range of benefits to both employers and employees, positioning SIB at the heart of Kenya’s expanding pensions landscape.

The founder behind the legacy

James Wangunyu, a former Chairman and Vice-Chairman of the Nairobi Securities Exchange, is recognised as one of Kenya’s most influential financial leaders. This influence was cemented and celebrated in October 2025 when the National Heroes Council declared Mr. Wangunyu a National Hero in Entrepreneurship and Industry under the Capital Markets & Investment Banking Category. His philosophy remains at the heart of SIB’s evolution: “When finance serves people, prosperity follows.”

Guided by his Catholic faith and decades of hands-on market experience, he continues to steer SIB with humility, discipline, and unwavering commitment to clients.

The next 30 years: Leading African capital markets going forward

Looking ahead, SIB’s next chapter is defined by an ambitious but clear vision for leadership across African capital markets. The firm is positioning itself for Pan-African expansion, building investment solutions that serve not only Kenya but the wider East African region and, ultimately, the continent. Islamic finance will remain a central pillar of this growth, with SIB Najah and the Mansa-X Shariah Funds set to evolve into continental benchmarks for faith-aligned investing.

Technology will also shape the future of SIB, with a strong focus on AI-driven insights, digital onboarding, real-time analytics and a suite of future-ready tools designed to enhance transparency and investor experience. Alongside innovation is a commitment to inclusive wealth creation, ensuring that youth, the diaspora, SMEs, pension schemes and faith-based communities all gain access to structured, professionally managed investment opportunities.

SIB will continue to advance sustainable capital markets, championing green finance, infrastructure investment vehicles, and responsible governance frameworks that align Africa with global standards.

As the firm prepares to move into its new headquarters, these priorities reinforce one message: SIB is ready to lead the next era of investment excellence in Africa.

A Kenyan story. An African legacy. A future built on trust

From a banker’s dream at Rehani House to a 250-person institution serving tens of thousands of investors, Standard Investment Bank’s 30-year journey reflects what disciplined vision, ethical leadership and African ingenuity can achieve.

Standard Investment Bank staff in 2020.

As SIB marks this milestone, one truth stands clear: Africa’s financial future will be shaped by institutions that honour their heritage, innovate boldly, and place clients at the heart of everything they do. SIB is proud to be one of them, and is excited for the next 30 years of possibility.