MPs now want all new Power Purchasing Agreements signed by the government to be in local currency as opposed to foreign to reduce the high cost of power.

Members of Parliament now want all new Power Purchasing Agreements (PPAs) signed by the government to be in local currency as opposed to foreign to reduce the high cost of power.

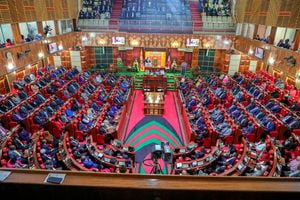

The National Assembly Committee on Energy, in its report on the probe of the high cost of power in the country, has recommended the amendment of the Energy Act, 2019 to effect the demand of all onboarding new PPAs to be in local currency.

In the report, the committee noted that most of the PPAs that the government has, some lasting up to 30 years, are in foreign currency which in the long run becomes expensive to the government when paying the power companies, a cost that is passed to consumers in their power bills.

“All new power generation plant PPAs to be boarded to the grid are denominated in Kenyan Shillings. The Committee shall initiate an amendment to the Energy Act 2019 to effect this recommendation,” reads the committee report.

The PPAs with the Independent Power Producers have been a major concern of the committee as they claimed a majority of them were skewed and did not favour the government.

Due to this, consumers end up paying more electricity costs borne from the skewed drawn power purchasing agreements.

The committee chaired by Mwala MP Vincent Musyoka noted that most of the IPPs including those locally owned are denominated in foreign currencies such as the Euro and USD which expose Kenyans to the risk of exchange rate fluctuation and inflation.

“The payment to the Independent Power Producers is in foreign currency, a forex risk that disadvantages the government and the off-taker,” reads the report.

High costs

The committee pointed out that the high costs associated with IPPs result in increased tariffs to the end-users.

The committee also wants all independent power producers in the pipeline to incorporate the decommissioning costs as a percentage of the capacity charges which will be paid into an escrow account managed by the National Treasury.

Capacity charge is the component that helps the IPP to recoup its capital investment, fixed labour expenses, operation and maintenance expenses, repayment of debt and return on equity. The price is fixed throughout the term of the power purchase agreement (PPA) and is payable to the firm whether there was production or not.

The committee also noted in the report that the Independent Power Producers require guarantees and government support measures such as letters of support that increase the government's indebtedness.

Further, the report says that some of the IPPs are incorporated and domiciled in foreign jurisdictions that provide taxation havens and direct scrutiny of the regulator.

The committee regretted that there is a general opaqueness in the disclosure of beneficial owners of IPPs with a majority of them listing foreign companies as shareholders.

To cure this, the committee has called on the Business Registration Services (BRS) to submit to the National Assembly a report containing a list of the owners, beneficial owners, shareholders and directors of each entity operating as an independent power producer in Kenya.

The committee also said all new power purchase agreements will only be entered into with a power generation entity that has fully disclosed and registered full beneficial ownership in compliance with the Act.

The payment structure of contracts with the Independent Power Producers is the take or pay arrangement model and is drawn in long-term contracts averaging from 20 to 30 years.

Take or pay is a policy where taxpayers pay IPPs for power produced even if it has not been used.

The committee also noted that the procurement of IPPs is marred with a lot of irregularities and the process of procuring IPPs is not competitive.

“The Committee did not establish any credible process applied in onboarding,” reads the report.

The committee in its recommendation has called on the Ministry of Energy and Petroleum in conjunction with the National Treasury to fast-track the formation and operationalisation of an independent Power Producers’ Office modelled similar to South Africa one.

South Africa established an Independent Power Producers office in 2010 which according to the report has reduced tariffs through competitive procurement of new electricity generation capacity provided by Independent Power Producers.