Premium

Four oil marketers on the spot over erratic supplies

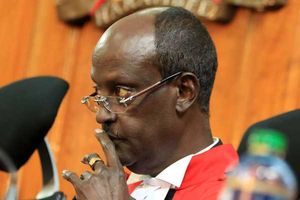

Petroleum ministry Principal Secretary Andrew Kamau during a media briefing on April 14. He has directed four oil marketers to sell the excess export stock they are holding in the local market.

What you need to know:

- Western Kenya faces shortages due to large number of independent retailers.

- State directs the firms to sell excess export stocks locally or face the consequences.

Four oil marketing companies (OMCs) are on the spot for holding large volumes of excess stocks of petroleum for the export market, despite erratic supplies in some parts of the domestic market.

An audit by the Petroleum ministry revealed that OMCs were holding 34 million litres of the excess transit volumes within the Kenya Pipeline Company (KPC) system as of Tuesday at 11am even as consumers in parts of the country, especially western Kenya and the North Rift, reported unreliable supply.

“This is completely unacceptable,” Petroleum Principal Secretary Andrew Kamau said in a protest letter to the marketers following the audit. He ordered the OMCs holding excess stocks of export products to re-route a total of 31.9 million litres to the local market.

The audit showed that Asharami, as of Tuesday, held the largest volume of excess export stocks with the state directing the company to sell up to 13.19 million litres of its consignment locally.

Total Kenya was also found with sizeable volumes of excess stocks of petroleum for export and directed to sell some 2.4 million litres in the domestic market.

Other firms that were found with large volumes of the excess export product were Lake Oil and Fossil Fuels, which were ordered to redirect two million and 1.53 million litres, respectively, to the domestic market.

“This is, therefore, to ask you to redirect your respective volumes to the local market by close of business today (Tuesday) failure to which we shall take action ... for sellers any product declared as local in excess of the transit volume of 40 per cent shall not be allowed to participate as a seller in the upcoming tenders. Furthermore, the equivalent of their respective ullage shall be reallocated to those selling to the local market,” Mr Kamau told the marketers.

The revelations turn the spotlight on the executives of the four firms barely two weeks after their counterpart, Jean-Christian Bergerone of Rubis Energy was reprimanded by the state over claims of abetting a fuel crisis through hoarding and higher exports.

Asharami is headed by Debola Adesanya, Total Kenya by Eric Fanchini, Fossil Fuels by Aman Kurji and Lake Oil by Nagib Hussein.

The audit revealed that other OMCs also held sizeable volumes of excess stocks for export. They include Starbex International with 708,000 litres, City Oil (K) Petroleum (890,000), Torch Energy (752,000) and Galana Oil Kenya (694,000).

“For buyers, their excess volume declared at transit will be reallocated in the next ullage allocation and their subsistent cargo firmed up will be reallocated accordingly. You have been granted a window of up to 6pm this evening. Please expedite,” Mr Kamau further said in his letter copied to Energy Cabinet Secretary Monica Juma, Energy and Petroleum Regulatory Authority (Epra) and KPC.

The Petroleum Outlets Association of Kenya (POAK), an industry lobby for dozens of independent oil dealers, on Monday claimed that some large OMCs had stopped selling to them and accused Epra of failing to enforce the law.

Market inquiries by the Nation early this week revealed that large oil marketers – hit by the high importation costs due to soaring global prices of the commodity – have elected to focus on their own franchised outlets, dealing a blow to independent oil marketers.

The large oil marketers have cut their stock purchases through the Open Tender System (OTS) amid liquidity challenges. This means the multinationals are now only prioritising supply to their franchised outlets as opposed to the independent dealers.

“Although the authority (Epra) is supposed to issue a maximum wholesale price as well to protect small retailers, this has not been happening (which) has left us exposed to exploitation,” POAK said in a statement on Monday. “At times, many of us have had to buy at pump prices to bring you fuel.”

Epra is required by the Petroleum Act of 2019 to set both maximum wholesale and retail prices to ensure price stability in the oil market.

The tug of war between the small and large OMCs has left several outlets, especially in western parts of the country, without sufficient stocks.

The region is hit hard by shortages because the market is dominated by small dealers. The large multinationals deserted the area decades ago, hit by the dumping of the export products meant for Uganda and the Great Lakes region.