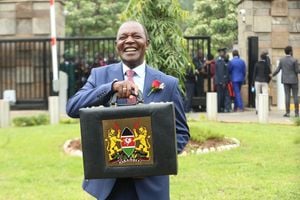

Treasury Cabinet Secretary Prof Njuguna Ndung'u displays the Budget briefcase ahead of his speech in parliament in Nairobi, Kenya.

The Finance Bill 2024 that was rejected by President William Ruto on Wednesday, June 26, following deadly protests contained a few saving graces.

For instance, monthly savings of up to Sh30,000 towards retirement schemes were scheduled for exemption from income tax after the Bill raised the threshold from the current Sh20,000.

The proposed 50 percent rise in the savings amount would have allowed the Kenya Revenue Authority (KRA) to exempt from tax up to Sh240,000 annual income contributed as pensions in retirement schemes.

Save for retirement

This was to be increased to Sh360,000 per annum, motivating people to save more for their retirement while lowering their tax liability.

The Bill also introduced two new categories of persons who would enjoy pension withdrawals tax-free, with the government proposing to scrap the current arrangement where only those who have attained the retirement age of 65 years or more access their retirement cash without paying taxes. The proposed law also meant good tidings for alcohol manufacturers by saving them from paying increased excise duty on spirits, which is based on pure alcohol content rather than volume. They will continue paying the tax within 24 hours, a requirement that has hurt their cash flow.

The Finance Committee had proposed, and Parliament approved, the period for payment of excise duty to be every fifth of the month, giving alcohol manufacturers some breathing space.

Small businesses and farmers had also been exempted from the Electronic Tax Invoice System (eTIMS), with traders with a turnover of less than Sh1 million being exempted from the requirement to produce an electronic tax invoice.

As part of its proposals on the Finance Bill 2024, the finance committee noted that farmers with a turnover of Sh1 million and below should be exempted from the implementation of the eTIMS.

The Bill had proposed to extend the capital allowance of 10 percent per year, to include a spectrum licence by a telecommunication operator. This investment allowance will apply on the remaining useful life of the licence where it is acquired before 1 July 2024.

Importers of clinker will continue paying an export and investment promotion levy of 17.5 percent, which has increased the cost of cement in the country affecting the building and construction industry.

President Ruto, however, said the tax on clinker has already started bearing fruits with a plant to manufacture cement being set up in West Pokot.

High inflation

The Bill had also proposed to increase the allowable value of meals served to employees in a canteen or cafeteria operated or established by the employer or provided by a third party who is a registered taxpayer meal benefit from Sh48,000 per annum to Sh60,000 per annum. This proposal was going to shield employees against the high inflation and rising cost of living.

“This proposal will also encourage employers to offer meals to their employees thereby saving them money on daily expenses and effectively enhancing their overall compensation package.”

Tea packaging materials were also going to be moved from the standard rate of 16 percent to exemption, a major boost for exporters of the leaf which is a major source of forex earnings.

Lawmakers had also proposed to exempt fertilised eggs from incubation amongst others from excise duty. Additionally, MPs proposed to reduce the rate of excise duty for imported sugar confectionery and spirits of undenatured ethyl alcohol.