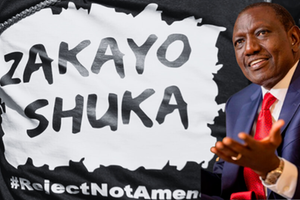

Treasury Cabinet Secretary John Mbadi (left) and President William Ruto. The Parliamentary Budget Office has cautioned the state against ambitious targets backed by the introduction of new taxes.

President William Ruto intends to collect Sh13.4 trillion taxes from Kenyans in his first term amid pressure from the International Monetary Fund (IMF), even as his unpopular tax policies cause public outcry.

Based on official State papers, the National Treasury targets to cross the Sh3 trillion annual tax revenues in the fiscal year starting July and eventually cross the Sh4 trillion mark in 2028/29.

Treasury, in the 2025 Budget Policy Statement (BPS), projects to collect Sh2.63 trillion in the current fiscal year (ending June 2025), raise the ordinary revenue to Sh3.019 trillion in the fiscal year starting July and Sh3.42 trillion in 2026/27.

“In the financial year 2025/26 total revenue including appropriation-in-aid (A-i-A) is projected at Sh3,516.6 billion from the projected Sh3,060.0 billion in financial year 2024/25.

Of this, ordinary revenue is projected at Sh3,018.8 billion from the projected Sh2,631.4 billion in the financial year 2024/25,” Treasury notes in the 2025 Budget Policy Statement (BPS).

This will mean that between July 2022 and the end of June 2025, the Kenya Revenue Authority (KRA) will have collected Sh13.4 trillion in taxes.

KRA netted a total Sh4.33 trillion during the two previous fiscal years (Sh2.04 trillion in 2022/23 and Sh2.29 trillion in 2023/24), which saw a number of taxes introduced by the government amid pressure from the IMF.

In the current fiscal year (ending June 2025), the Treasury is targeting to raise Sh2.63 trillion taxes, out of which it had managed Sh1.07 trillion by end of December 2024.

Since his entry into office, the President has introduced the Housing Levy at the rate of 1.5 per cent of an employee’s salary, doubled the VAT on petroleum products to 16 per cent, increased pay-as-you-earn (PAYE) tax for high earners, and other taxes affecting Kenyans day-to-day livelihoods.

The taxes have faced public outrage due to their impact on payslips and business revenues, culminating at the withdrawal of the Finance Bill 2024 amid countrywide protests last year.

The Treasury had originally targeted to collect Sh2.9 trillion in ordinary revenue during the current fiscal year in the Finance Bill 2024, but revised down the targets to Sh2.63 trillion after it was withdrawn.