Premium

Setback for business, county revenues as protests hit Nairobi, Kisumu

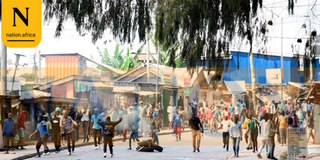

Azimio leader Raila Odinga's supporters clash with police officers in Kibra, Nairobi, on March 20, 2023, during protests against President William Ruto's administration.

The economy took a hit Monday as hundreds of businesses shut down, mainly in the capital, Nairobi and Kisumu, following demonstrations called by Azimio leader Raila Odinga.

Both large and small businesses counted losses as the demonstrations stopped operations.

The Nairobi Securities Exchange (NSE) reported a mixed picture after investor wealth rose by Sh56 billion Monday compared to Friday, buoyed by gains on the Safaricom share price amid demonstrations that paralysed business activity in the city.

Data from the NSE showed market capitalisation stood at Sh1.66 trillion at close of trading on Monday, having gained from Friday’s Sh1.61trillion.

The shares traded however dropped from 83.7 million on Friday to 22.8 million yesterday-- a 72.6 per cent drop that indicated investors’ lethargy in the wake of protests whose impact on the economy is heavy.In Nairobi-- which was the epicenter of protests-- businesses remained shut throughout the day, with few that had attempted opening in the morning closing shortly later as it became apparent that they risked huge losses on looting.

Deputy President Rigathi Gachagua claimed businesses lost an estimated Sh2 billion due to the protests yesterday.

Many of the businesses that were affected were shops retailing different products, eateries, supermarkets, and service businesses, both within the CBD and on the outskirts, where pockets of unrest were witnessed.

“Shops have been closed due to the unrest resulting in lost incomes, which has a larger impact on the general economy. It has also led to a loss of manpower in terms of people who can’t reach their offices out of fear or out of transport challenges,” said Retail Traders Association of Kenya (Retrak) CEO, Wambui Mbarire.

The protests, coupled with global uncertainty caused by troubled Credit Suisse Bank, also hit the Kenyan Shilling which has been on a steep devaluation trend in recent months. The Shilling slumped to another record low to exchange at 130.0088 units against the US Dollar yesterday, marking a 0.097 percent slump from where it was by Friday, according to the Central Bank of Kenya (CBK).

The shilling has lost 5.3 percent of its value against the USD since the start of this year.

The protests hit transport businesses in many parts of the city. Roads in different parts were also blocked by both police and protesters, largely paralyzing transport, while many public transport vehicles were packed, a key pointer to the impact many businesses faced as they could not transport goods, or move people to different points. In Nairobi, roads were clear of the usual traffic jam, while in other towns that witnessed protests, vehicles were also kept away.

It was not only road users who were affected since Kenya Airways (KQ) also shut its Kisumu town booking office.

“KQ wishes to inform our customers that our town booking offices in Johannesburg, South Africa, and Kisumu, Kenya will remain closed on Monday, March 20, 2023, and reopen on March 21 due to the anticipated protests in these cities,” KQ said in a Sunday evening statement.

The protests either did not do any good to the stability of the Kenyan Shilling which has been on a steep devaluation trend in recent months. The Shilling slumped to another low to exchange at 130.0088 units against the US Dollar yesterday, marking a 0.097 percent slump from where it was by Friday, according to the Central Bank of Kenya (CBK).

The shilling has lost 5.3 percent of its value against the USD since the start of this year.

The Nairobi and Kisumu county governments will also feel the heat of the demonstrations, with one of their biggest revenue streams- parking fees- hard-hit as motorists parked their vehicles at home to avoid exposing them to damages.

Nairobi collects an average of Sh5.3 million daily as parking fees, which forms 30 percent of its annual own revenues, according to the Controller of Budget’s latest report (July- December 2022.

And with the streets of Nairobi rendered uninhabitable amid fears of unruly protesters who take advantage to loot, none of the thousands of hawkers who dot city streets dared operate.

“It’s unfortunate because hawkers rely on daily earnings and so today very many will not put food on the table. The demonstrations are not really helping small traders; they are actually messing with them because they cannot do their business. There is a need for dialogue, this country’s economy is not doing well,” urged Kenya National Hawkers Association National Chairman John Kihiu.

The association estimates that Nairobi’s CBD has about 25,000 hawkers, although City Hall last year indicated that about 3,000 hawkers operate within CBD.