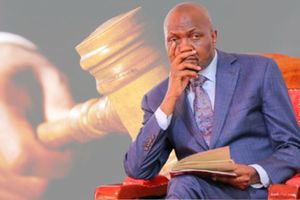

Mr Moses Kuria.

President William Ruto’s senior economic adviser Moses Kuria has failed in his bid to stop Equity Bank from auctioning his property in Kiambu over a Sh54 million debt.

High Court judge Aleem Visram on Monday ruled that Mr Kuria had failed to meet the threshold required to stop the public sale.

The judge said the bank had carried out the process of debt recovery in accordance with the law, the money owed expressly admitted and remained due, and has been outstanding for a prolonged period.

“Further, it is evident that all efforts to renegotiate the terms of repayment and to compromise the matter in an amicable manner have failed. There is therefore no valid ground upon which the Bank ought to be restrained from exercising its statutory power of sale,” said the judge.

Mr Kuria had rushed to court to stop the lender to stop the lender and Garam Investments Auctioneers from selling the land in Kiambaa, Kiambu County.

The court heard that the former Investments and Trade Cabinet Secretary took a loan of Sh54 million from the bank on March 15, 2018. The loan was for the construction of five-storey rental blocks on two of the properties.

The parties agreed that Mr Kuria would be allowed a moratorium on principal repayment for a period of nine months from the date of the first disbursement.

Evidence showed that the loan would be repaid in 111 installments compromising of both principal and interest in the sum of Sh402,832, each until the clearance of the loan.

The loan was secured using three properties in Kiambu.

Covid-19 pandemic

Mr Kuria did not deny the debt, but defended himself saying he was unable to service the loan because he could not develop the properties due to the Covid-19 pandemic.

The former CS had claimed that the pandemic caused a surge in the price of building materials and that he fell sick during the period and was admitted in hospital for rehabilitation of his leg which was damaged during an accident.

He revealed that the bank had threatened to sell one of the properties, which contained five-storey block with 27 units.

Mr Kuria said he had completed the houses and engaged the bank with plans of repaying the loan.

Court records showed that as at June 2022, Mr Kuria stopped servicing the loan. By the time the lender issued notices for sale of the property, the outstanding loan stood at Sh54.3 million

The bank said Mr Kuria was unable to service the loan as agreed, forcing the lender to issue notices and exercise its statutory power of sale.

Justice Visram said looking at the record, it was evident that the former CS was unable to service the loan, and the facility fell into arrears.

The bank submitted that on January 24, 2025, Mr Kuria agreed to settle the arrears by Sh850,000 monthly payments but he failed to do so.

Mr Kuria on his part said he made a payment of Sh733,000 to clear the arrears.

“However, I take note that the said payment is less than the sum agreed to be paid between the parties, and based on the record, to date, no such appropriate payments have been made in accordance with the various agreement of the parties, prompting the Respondent to issue instructions to the 2nd Defendant (Garam) to sell the subject Properties,” said the judge.

The judge said there was evidence of correspondence between the parties over the default, and reminders to the former CS that payments were due.

Justice Visram said while he empathized with Mr Kuria for suffering from health challenges, and was even hospitalised for a period between 2020 and 2021, unfortunately, the same was not a legal ground for the grant of the injunctive orders in circumstances.

“I am satisfied, in light of the above, that the relevant statutory notices were duly served on the Applicant, and that the Bank’s statutory powers of sale have crystalized in accordance with the law,” said the judge.

The court noted that the lender had carried out the process of recovery in accordance with the law and there was no valid ground upon which the bank ought to be restrained from exercising its statutory power of sale.