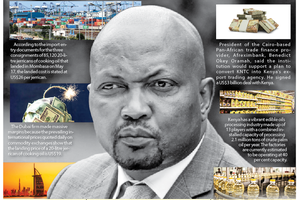

Mr Moses Kuria.

Mr Moses Kuria, the first among equals in President William Ruto’s Council of Economic Advisers, has for over two years denied ownership of UAE-registered InvestAfrica-FZCO, a company that has made big moves in the public and private sectors.

On August 24, 2024, President Ruto appointed Mr Kuria to the council, barely a month after booting the former Gatundu South MP from his Cabinet on the backdrop of youth-led anti-government protests.

When an auctioneer last week advertised for the sale of two blocks of apartments in Juja and Ruaka, the information gave a subtle, but intimate connection between Mr Kuria and InvestAfrica-FZCO – a postal address.

On one side of the table, Mr Kuria is facing an auction of his properties for an undisclosed debt to an unnamed creditor.

On the other, InvestAfrica-FZCO has made big, curious but seemingly strategic moves on struggling firms listed at the Nairobi Securities Exchange, the most recent being the acquisition of Kenya Orchards Ltd (KOL) in a deal estimated to be worth at least Sh210 million.

InvestAfrica-FZCO had two years earlier acquired a stake in Eveready EA, which was at the time lossmaking.

Last Friday, Mr Kuria maintained that he does not own InvestAfrica-FZCO.

The advertisement by Garam Investments Ltd last week revealed that Mr Kuria and InvestAfrica-FZCO share a postal address.

InvestAfrica-FZCO is also listed as the beneficial owner of Smith & Gold Productions, a firm that won a Sh259 million tender for the construction of Karatu Stadium in Kiambu County.

Mr Kuria was listed as the beneficial owner of Smith & Gold Productions until 2023 when the ownership structure changed in favour of InvestAfrica-FZCO.

Emerging Capital Holdings owns 700 shares in Smith & Gold Productions, while Alois Kinyanjui, Mr Kuria’s brother, owns 300 shares.

InvestAfrica-FZCO owns all shares in Emerging Capital Holdings.

Save for a court order, or payment of an undisclosed debt, the auctioneer’s hammer will land on the Ruaka and Juja buildings, both owned by Mr Kuria but trading as Briden Apartments, on April 8, 2025.

Anyone who wishes to wrestle the two properties off Mr Kuria’s hands will have to pay a refundable Sh3 million bidding deposit to Garam Investments, the auctioneer selling the properties, and then square it out with other potential buyers on April 8.

The winning bidder will have to pay a 10 per cent deposit at the fall of the hammer and complete the rest of the purchase price within 90 days. Failure to complete payment in that time will result in forfeiture of the deposits paid, the advertisement by Garam Investments stated.

Eight one-bedroom units

In the Kalimoni area of Juja town in Kiambu County, Mr Kuria owns a five-storey block of apartments. It is approximately 250 metres off Thika Road. It sits on two separate pieces of land, totalling 0.009884 acres.

The ground to fourth floors each have eight one-bedroom units. The fifth floor has a bedsitter and a one-bedroomed unit. The land’s title deeds are on freehold interest, leaving them free of annual land rent to Kiambu County.

Garam Investments said in its advertisement that the building rakes in approximately Sh541,000 every month in rental income.

The Ruaka block, also in Kiambu County, is located 160 metres off Limuru Road and is approximately 650 metres away from the Alma by Cytonn.

The five-storey building sits on a 0.1137-acre piece of land, also on freehold interest. The ground floor has two bedsitters and 15 parking bays.

The first to fourth floors each have three one-bedroomed units, two two-bedroomed units and one bedsitter. The fifth floor has two bedsitters.

The auction comes barely nine months after InvestAfrica-FZCO acquired KOL, whose products are branded as KOL.

The UAE, where InvestAfrica-FZCO is registered, has strict laws protecting beneficial owners of companies from the public eye. In some countries like Kenya, any member of the public can obtain ownership information of a company by paying a fee to the Business Registration Service.

In the UK, that information is availed for free, alongside details of directors and shareholders.

InvestAfrica-FZCO, which is registered in the UAE, incorporated Africa Mega Agriculture Corporation Ltd on November 24, 2023.

In June 2024, KOL issued a cautionary statement at the Nairobi Securities Exchange, to the effect that it had received an offer from Africa Mega Agriculture Corporation (Amac), to purchase 10,863,537 shares, or 84.423 per cent of the consumer goods manufacturer.

KOL manufactures several food and associated items such as canned beans, tomato sauce, fruit jam, tomato paste and several others.

Naushad Merali, founder of Sameer Group.

The shares AMAC purchased were from Westpac Holdings Ltd (34.282 per cent), Thakarshi Keshav Patel (33.606 per cent), Vipul Thakarshi Patel (14.886 per cent) and Hansa Dinesh Chandra Shah (1.649 per cent).

At the time of the cautionary statement, KOL’s shares were trading at Sh19.50-a-piece. That means that AMAC may have paid Sh210 million to the four shareholders.

Neither KOL nor AMAC made public the total value of the transaction.

In January 2025, KOL rebranded to AMAC Agri Corp PLC and is still trading on the Nairobi Securities Exchange. Its share price closed at Sh51 on Friday. In early March, the share price hit a high of Sh57. In December 2024, the stocks had hit Sh70.

InvestAfrica-FZCO made its debut in the Kenyan trade industry in February 2023, when it became one of several firms given contracts by the Kenya National Trading Corporation for the import of edible oils worth Sh17 billion.

InvestAfrica-FZCO got a Sh1.33 billion contract through its wholly-owned subsidiary, Shehena Commodity Ltd.

Two months later, InvestAfrica-FZCO bought a 35 per cent stake in battery dealer Eveready EA, from the family of industrialist Naushad Merali.

InvestAfrica-FZO issued a notice in April 2023, after getting a go-ahead for the transaction from the Capital Markets Authority.