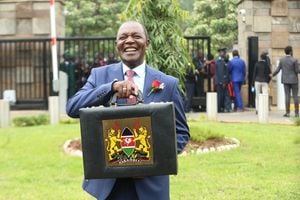

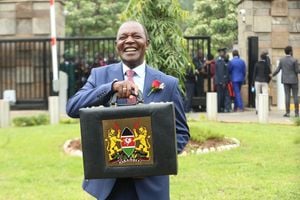

Members of the public demonstrate in Nairobi on June 6, 2024 against the proposed Finance Bill, 2024.

The country might be staring at a major economic crisis and job losses after various businesses threatened to exit the Kenyan market over some contentious proposals contained in the Finance Bill, 2024.

Already, the civil society groups including NGOs churches, and businesses have made their submissions before the Finance and National Planning Committee opposing the various amendments in the revenue-raising Bill for the fiscal year 2024/25.

Some of the contentious proposals include the introduction of the 2.5 per cent motor vehicle tax, 16 per cent value-added tax (VAT) on bread and bank services, and increase of excise duty on financial transactions from 15 to 20 per cent.

The Bill also introduces a new tax known as an eco levy on several products deemed harmful to the environment, including diapers, batteries, rubber tyres, television sets and smartphones.

Businesses through their lobbies have particularly been vocal, warning of a tough operating environment that might force some of them to shut down or lay off employees should the Finance Bill be passed by the National Assembly in its current form.

The Kenya Bankers Association (KBA) said introduction of VAT on banking services and the increase of excise duty on financial transactions from 15 to 20 per cent is also likely to roll back the progress the country has made in financial inclusion if implemented.

KBA acting chief executive officer, Raymond Malonje, told the Finance Committee which is led by Molo MP Kimani Kuria that the 16 per cent VAT will heavily impact the issuance of credit and debit cards, foreign exchange transactions, clearance of cheques, and other banking services.

“Whilst the imposition of VAT on these financial services is intended to enhance revenue collection, it will directly increase the cost of these services which may limit the access and affordability to the ordinary Kenyan,” Mr Malonje said.

“More specifically the introduction of VAT on forex transactions in Kenya directly increases the cost of doing business for companies involved in international trade. Businesses that import goods or services will bear higher costs rippled through the supply chain leading to higher prices for individual consumers,” he added.

Members of the public demonstrate in Nairobi on June 6, 2024 against the proposed Finance Bill, 2024.

Players in the aviation sector, through their lobbies the Association of Air Operators (KAAO) and the African Airlines Association, said Kenya will lose its regional aviation competitiveness to its neighbours if the Treasury proposal to impose 16 VAT on the importation of aircraft and spacecraft, direction-finding compasses, instruments, and appliances for aircraft.

“The intended removal of VAT exemptions will have a direct impact on our regional competitiveness and impact the advancement of Kenya’s aviation sector,” Mr Mbuvi Ngunze, the KAAO chairman said.

“Policymakers must realise the multifaceted implications of such actions and prioritise strategies to safeguard these critical exemptions in line with both the International Civil Aviation Organisation and the East African Common External Market Tariff on zero-rated taxes on aviation,” Mr Ngunze added.

Several companies, including the East African Breweries Limited (EABL), Coca-Cola, Uber, and Bolt, warned of job losses should some of the contentious clauses contained in the Bill become law.

Alcohol manufacturers said the proposals would deny them refunds on excise duty paid on inputs, including ethanol, the raw material for alcohol.

Because manufacturers pay excise duty on the final product, manufacturers argue this amounts to double taxation.

They said should the amendment be retained, it would be cheaper for companies to import the final product, a move that will result in layoffs as plants are shut down.

“When you are making an investment decision, you always look at which market can give you the best return in a good time,” said Mr Eric Kiniti, the Corporate Relations Director at EABL.

“And what we are saying is that Kenya at the moment does not give you an opportunity and that is why you see even significant investments in the industry have been waning,” he added.

Soft drinks manufacturer Coca-Cola — whose plastics are set to be subjected to the eco levy at Sh150 per kilogramme while those manufactured locally get slapped with an additional 10 per cent excise tax — have also warned of the high cost of operations, said Mr John Mwendwa, Coca-Cola Director for Public Affairs, Communications & Sustainability.

Members of the public demonstrate in Nairobi on June 6, 2024 against the proposed Finance Bill, 2024.

“By imposing excise duty on locally produced plastics, this will increase the cost of production and thus increase the cost of goods that require the use of plastic packaging,” Mr Mwendwa said.

With the Bill proposing to introduce the significant economic presence (SEP) tax which targets foreign companies that provide services in Kenya, but have no office in Kenya, taxi-hailing companies including Uber and Bolt, have warned of job losses should the clause be passed.

Such players will be expected to pay SEP of 30 per cent of the deemed taxable profit. The taxable profit of a person liable to pay the tax shall be deemed to be 20 per cent of the gross turnover, which puts SEP at 6.3 per cent.

President William Ruto’s government wants to raise an additional Sh234 billion in taxes in the Fiscal year 2024/25 by implementing the revenue-raising amendments contained in the Bill.

Overall, the government is targeting tax collections worth Sh2.94 trillion in the next fiscal year, up from Sh2.62 trillion in the current year ending this month.

The Kenya Revenue Authority (KRA) has, however, been falling behind the target, a move it intends to solve by using technology such as e-TIMS to nab the tax cheats and reduce tax leakages.

Various ministries, departments, and agencies have also been forced to increase the fees and fines they charge to supplement taxes collected by the Kenya Revenue Authority in a double-pronged onslaught that critics fear might trigger an economic crisis.

Data from the Kenya National Bureau of Statistics shows that for four consecutive years, pay increments have trailed the increase in the cost of living, leaving a lot of households squeezed.

President Ruto insists that the additional taxes are aimed at reducing the country’s debt risks while helping finance critical projects under the Kenya Kwanza administration’s bottom-up economic plan.

Dr Ruto said he intends to push the taxes collected as a percentage of GDP to 22 percent by the end of 2027 from the current 16 per cent, a tall order that might be achieved by either broadening the tax base or increasing tax rates.