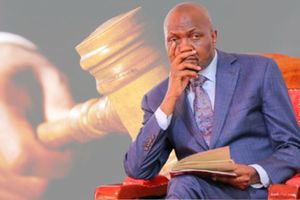

Moses Kuria, a senior economic advisor in President William Ruto’s office.

On April 8, 2025, the auctioneer’s hammer landed on a block of apartments in Ruaka owned by Mr Moses Kuria, a senior economic advisor in President William Ruto’s office, after the highest bidder offered Sh62 million.

Garam Investments last month advertised for the auction of the Ruaka apartments, alongside another block in Juja, after being instructed by Equity Bank to recover a Sh54 million loan owed by the former Trade and Industry Cabinet Secretary.

However, the auction of the Ruaka property and plans to sell off the Juja block have hit a snag following a court ruling based on a legal principle that has, in the last few years, seen many financial institutions and land buyers burn their fingers – spousal consent.

Justice Jacqueline Mogeni last Friday blocked Garam Investments from auctioning the Juja apartments after Mr Kuria’s wife, Joyce Njambi Gathungu, filed a case arguing that both the Ruaka and Juja properties are matrimonial assets.

Ms Gathungu further held that Equity Bank did not seek her consent, as Mr Kuria’s wife and significant stakeholder in the properties, before registering them as securities for Sh54 million loans that the former CS borrowed in March 2018.

Ms Gathungu is also seeking to revoke the auction of the Ruaka apartments. The dispute could delay, or even stop, the new buyer’s acquisition if Ms Gathungu’s case is successful.

Justice Mogeni ordered that Ms Gathungu’s case be heard on April 30 and that no transfer of the Ruaka property to the successful bidder or auction of the Juja apartments before then.

Also Read: Moses Kuria’s properties up for auction

Equity Bank is all too familiar with the legal principle, as it and many other lenders have lost several auction bids in the last five years on account of getting consent from spouses before charging prime assets for loans.

Projection

In property disputes where spousal consent is raised, the court is tasked with first determining whether both the man and his wife have an ownership stake in the asset.

If the court determines that both individuals have a proprietary interest in the asset and that the lender or potential buyer did not seek the other spouse’s consent was not sought, then the judge will, in most cases, quash the transaction at the centre of the case.

Justice Mogeni will, through the hearing of the case, attempt to determine whether Ms Gathungu has a proprietary interest in the two assets, and then make determinations on whether to stop the planned distress sales.

But for now, because Ms Gathungu has raised the possibility of loss on account of the auctions, Justice Mogeni has ruled that no transfer of the assets be completed.

Her case reveals that valuations have estimated the Ruaka property to be worth over Sh60 million, and the Juja one at Sh40 million.

Ms Gathungu holds that Equity Bank ignored her attempts to get statements on the loans owed by Mr Kuria and a pledge to help repay the borrowings.

Equity Bank branch on Kimathi Street, Nairobi County.

“The properties aforementioned were part of matrimonial properties with my children and I living in my matrimonial home in the Ruaka property and having matrimonial rights in the Juja property. On or about April 8, 2025 I was reliably informed that the Ruaka suit property was set to be sold by public auction for an alleged default,” Ms Gathungu says in court papers.

“Immediately I learned of the same I walked to Equity Bank and requested for documentation on the two properties but the 1st respondent (Equity Bank) was not forthcoming despite numerous demands to provide the same and my undertaking to continue liquidating the loan amount when it falls due in order to secure my properties. All along I was never served with notices of sale or demand letters as required of a spouse,” Ms Gathungu added in her court papers.

A week before Ms Gathungu’s case, Mr Kuria’s court bid to block the auction flopped after another High Court judge, Aleem Visram, declined to issue orders suspending the April 8 auction, just a day before the exercise.

Garam Investments last month advertised for the auction of the two properties after being instructed by Equity Bank.

'Covid-19 impacted business'

In a case against Equity Bank and Garam Investments, Mr Kuria claimed that his finances had been affected by the Covid-19 pandemic, which affected his businesses and his overall cashflow.

Mr Kuria argued that the Covid-19 pandemic affected development of the apartments, during which period the cost of construction materials significantly went up and affected his initial plans.

He also blamed the loan defaults on medical bills following an accident with an electric blanket that left Mr Kuria in need of at least seven surgeries to repair damage to his leg.

Justice Visram sided with Equity Bank, faulting Mr Kuria for failing to honour a January, 2025 agreement to pay Sh850,000 monthly installments towards the loan facility.

Mr Kuria paid Sh733,000 to Equity Bank on March 18, 2025, but Justice Visram held that the amount was lower than the agreed monthly installments.

Assets in question

Both properties trade as Briden Apartments.

The Juja apartments are on a five-storey building approximately 250 metres off Thika superhighway, sitting on 0.009884 acres.

The ground to fourth floors each have eight one-bedroomed apartments. The fifth floor has a bedsitter and one-bedroomed unit.

Garam Investments, in its auction advertisement, said that the Juja apartments rake in Sh541,000 when all units are rented.

The Ruaka apartments are also in a five-storey building, sitting on 0.1137 acres, approximately 160 metres off Limuru road.

The ground floor has two bedsitters and 15 parking slots.

The first to fourth floors each have three one-bedroomed units, two two-bedroomed units and one bedsitter. The fifth floor has two bedsitters.

At full capacity, the Ruaka property rakes in Sh699,000 each month.