Prices of cooking oil averaged Sh332.37 per litre in October 2024.

Processors of edible vegetable oil used palm oil supply shortages and foreign exchange crisis to overcharge consumers by Sh67.73 billion between July and December 2022, a new report suggests, pointing to possible weak competition and collusion in the industry.

An investigation by the Comesa Competition Commission into doubling of vegetable oil prices from the start of 2021 to mid-2022 found that manufacturers in Kenya continued to increase the cost of the staple commodity even after the input expenses declined.

The competition watchdog’s findings, based on official statistics and interviews with producers, established that consumers in Kenya paid additional $525 million (about Sh67.73 billion where $1= Sh129) to purchase cooking oil between July and December 2022, for instance, even after input costs dropped compared with a similar period a year earlier.

The additional cost for Kenyan consumers in the six-month period was more than seven times compared with $60 million (Sh7.74 billion) in Zambia.

The investigators said they considered “the higher margins over variable costs in the second half of 2022 compared with the average margins over the previous year in Kenya” in arriving at the number.

“The pricing of vegetable oil and, in particular, the very high increases and the sustained high consumer prices even after input costs returned to their earlier levels, points to weak levels of competition. The phenomenon of prices rising quickly in response to cost shocks and only adjusting back slowly, exhibiting asymmetric adjustment, is known in competition economics as ‘rockets and feathers’ – increasing upwards like a rocket and only coming down slowly like a feather,” the Comesa body wrote a newly-published study on vegetable oil value chain in East and Southern Africa.

The investigators added: “There are different possible explanations including low levels of competition and the existence of collusion, however, an investigation or inquiry is required to ascertain the factors at work.”

The report states while the increased retail costs of cooking oil between January 2021 and March 2022 largely reflected growth in international crude palm oil prices and shipping expenses, they deviated thereafter with falls in raw materials and freight charges not being transferred to consumers.

The Comesa agency generally found that manufacturers of cooking oil raised consumer prices by bigger rates than increases in crude palm prices and continued to increase costs for consumers even after crude palm oil prices decreased after the first quarter of 2022.

This resulted in “a much bigger gap between the consumer prices and this major input cost”, pointing to “greedflation” tendencies amongst edible oil processors.

The watchdog cites July 2022 when the producers continued to raise the consumer price of cooking oil despite the crude palm oil costs having dropped by 40 per cent and were below the prices in early January 2021.

“Prices of refined cooking oil continued to increase and margins over costs in the second half of 2022 were more than double those of the previous 18 months,” the report states.

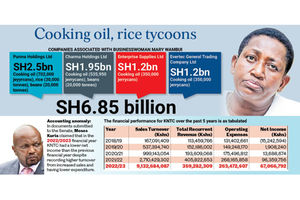

President William Ruto administration responded to elevated cost of cooking oil by entering into deals with private firms to import the commodity in controversial Sh16.5 billion tenders through Kenya National Trading Corporation (KNTC). KNTC has since admitted Kenya lost at least Sh6.5 billion in the controversial edible oils importation deal.

Prices of cooking oil are still relatively elevated, averaging Sh332.37 per litre in October compared with Sh274.22 in the same month in 2021, according to Kenya National Bureau of Statistics.

The commodity retailed at an average of Sh366.48 per litre in October 2022 before falling to Sh325.94 a year later.

Manufacturers of cooking oil in Kenya rely on crude palm oil imports, largely from Malaysia and Indonesia, which they then refine into finished products.

Kenya’s an annual installed refining capacity is estimated to be 1.5 million metric tonnes, but utilises about 60 percent of that capacity.

Bidco, Pwani and Kapa Oil account for nearly 90 percent of the production capacity in a market of about six players, according to the Comesa competition watchdog.

Some manufacturers in mid-2022 blamed difficulties in accessing adequate US dollars from banks amidst stiff global competition for crude palm oil for keeping consumer prices elevated.

“We are suffering from not being able to get enough raw materials [crude palm oil] to process our products. Getting adequate dollars from banks at the moment is not just possible. That’s causing a lot of problems in getting raw materials in because suppliers need to be paid in dollars,” Pwani Oil director for commercial development Rajul Malde told the Business Daily on June 3, 2022.

The global prices of crude palm oil sky-rocketed initially due to drought in Southeast Asia in 2021 followed by protectionist export rules in Indonesia which prioritised supply to domestic factories.

The protectionist export rules in Indonesia, which accounted for about 60 per cent of global exports, left Malaysia as the main source of the crude palm oil.

Crude palm oil imports account for about 80 percent of the total production costs for cooking oil, the Comesa agency says, citing interviews with Kenya’s edible oil refineries in March 2023.

Other costs include transport expenses, an import declaration fee of 3.5 per cent on custom value, railway development levy at the rate of 2.0 per cent and VAT at the rate of 16 per cent of value of imported goods.

The edible manufacturers said the cost of crude palm oil rose from $700 per tonne in mid-2019 jumping to $1850 in August of 2022, before falling to $1,100 in April 2023, the report states.