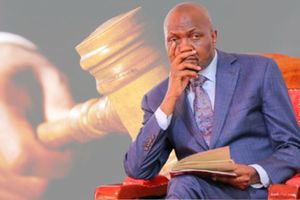

Founder and former chairman of Equity Bank Group Peter Munga.

Founder and immediate past chairman of Equity Bank Group Peter Munga has been dealt a fresh blow after a judge in Kiambu lifted an order blocking ABC Bank from auctioning his Sh75 million shares in Britam Holdings.

Justice Dorah Chepkwony discharged the order the billionaire businessman had secured in February stopping the lender from auctioning the shares to recover a loan of Sh433.76 million owed by Equatorial Nut Processors Limited, a firm that Mr Munga has majority shares.

This was after the judge was informed that the tycoon had failed to disclose that a similar application was dismissed by another judge sitting at the Milimani Court in Nairobi on January 29.

"Having confirmed that Mr Munga approached this court without disclosing that he had filed a similar suit seeking the same core reliefs before another court, this conduct constitutes an abuse of court process warranting immediate intervention, which is to set aside the ex parte interim orders issued on February 3, 2025," ruled Justice Chepkwony.

The judge noted that after the court was made aware of the failure to disclose the earlier case, Mr Munga lodged an application to withdraw the matter pending at the Milimani Court.

However, according to the judge, the bid to withdraw the matter was "not a cure of the initial concealment".

"This court is, therefore, duty-bound to protect the sanctity of its process by declining to endorse conduct that undermines the fair administration of justice,” said Justice Chepkwony.

After discharging the court order, the judge said parties were free to argue the pending prayers in the applications and set May 7, 2025 for mention and urged the parties to confirm compliance and take further directions.

With the lifting of the court order, ABC Bank is now free to auction the shares, valued at approximately Sh604 million, to recover the outstanding loan.

Evidence adduced in court showed that Equatorial Nut Processors where Mr Munga holds 92 per cent stake, defaulted on the loan, prompting the lender to seize the shares that had been used as collateral.

While dismissing the case in January, High Court Judge Alfred Mabeya had noted that the tycoon had willingly guaranteed the loan and offered his Britam shares as security.

The court emphasised that the businessman had willingly signed a personal guarantee and indemnity in favour of ABC Bank and was legally bound to repay the loan after Equatorial Nut Processors defaulted.

The company is a macadamia, peanut, and cashew nut processing enterprise located near Maragua Town in Murang’a County.

Mr Munga had downplayed the significance of the case pending at the Milimani Court arguing that it was different in substance and reliefs sought.

However, the judge rejected the submission stating that the pleadings disclosed that the reliefs, which were being pursued in both forums, were substantially identical, to stop the seizure and sale of the shares.

The judge made it clear that a litigant should not multiply applications before the same or different courts in the hope that eventually one court will grant the relief being sought.

"It is an abuse of court process for a party to re-litigate the same subject matter in multiple forums without disclosing prior or concurrent proceedings.

“Such actions not only amount to oppressive litigating tactics, but also downgrade judicial integrity and pose the risk of conflicting decisions being issued on the same subject," observed justice Chepkwony.

She further argued that a party cannot be allowed to go around the country filing similar cases in different courts with the hope that maybe one of the courts will give him the orders he wants.

"This conduct amounts to forum shopping, which is a discredited and impressionable litigation strategy where a party deliberately initiates the proceedings in different judicial forms hoping to secure favourable outcomes or avoid adverse decisions," the judge stated.