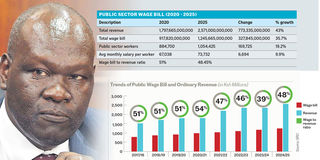

Government workers have crossed a million in number taking the public wage bill to a quarter past Sh1 trillion, as salaries now gobble up nearly half of taxes, leaving little resources for development.

Salaries and Remuneration Commission (SRC) data shows that public service workers hit 1,054,425 by June as the public wage rose to Sh1.25 trillion, even as the taxman struggled to collect taxes amid a rising debt burden.

Against an annual national revenue collection of Sh2.57 trillion, the wage bill to revenue ratio of 48.63 percent is far more than the recommended 35 percent, which means salaries take away resources that would have gone to development projects like building roads, schools and hospitals.

A review of the salaries spending over the years shows the government would have saved in excess of Sh1 trillion between 2020 and now had it observed this statutory ratio.

The number of public workers has grown by 169,725 since 2020 majorly due to frequent employment of teachers and workers in ministries, which has posed a huge challenge for the State to control monies it spends on salaries.

Growth in employment

“TSC (Teachers Service Commission) has consistently remained the largest public service employer, registering the highest growth in employment at 5.2 percent, where its employees increased from 390,400 in 2023, to 410,700 employees in 2024,” SRC says in the latest wage bill bulletin.

Between 2020 and this year, 79,600 more teachers have been employed raising their numbers by 24 percent, as ministries and agencies employed 30,600 (14.8 percent) new workers.

Together, the two levels contributed two-thirds of new workforce in government over the five years.

County governments have employed 21,900 new workers since 2020, increasing their numbers by 10.7 percent.

“The growth in the public wage bill is largely attributed to the increase in the workforce through employment in education, health, and security sectors, which are essential services,” SRC earlier explained in its annual report for the financial year ending June 30, 2024.

The hiring spree increased workers' numbers from 884,700 in 2020 to 923,000 the following year, before going up to 937,900 in 2022 and 992,900 the year after.

Government workers have crossed a million in number taking the public wage bill to a quarter past Sh1 trillion

Public workers crossed one million for the first time last year, hitting 1,023,200 and then growing further to 1,054,425 this year, the SRC data shows.

“Generally, the number of public service employees has been on a consistent upward trend over the years, crossing the 1 million mark in 2024 to reach 1.023 million employees,” SRC notes.

As the numbers have been growing, so has the budget to pay salaries in government, with spending rising from Sh917.8 billion in 2020 to Sh1.25 trillion in the year ending June 2025.

SRC has also cited the upward reviews of remuneration and benefits in response to cost of living adjustments and the need to attract and retain the requisite skills for the ballooning wage bill.

Ghost workers

Payments running into billions of shillings for ghost workers in the payrolls of national and county governments has also been cited in audit reports for the runaway wage bill.

The wage bill first crossed the Sh1 trillion mark in 2022 and has since gone up by 20.3 percent, underlining the pace at which it has been rising.

Compared to the amount of taxes the taxman is collecting, salaries paid to public workers remain far higher than the recommended ratio- maximum 35 percent of revenue- eating into 48.45 percent of taxes in the last fiscal year, though a marginal improvement from 51 percent five years ago.

The law prohibits public institutions from spending more than 35 percent of their revenues on salaries and allowances but many institutions continue breaching the requirement.

The Kenya Revenue Authority (KRA) has also been struggling to collect enough taxes and has been forced to revise targets downwards, including the last financial year, when it lowered the target from Sh2.9 trillion to an actual collection of Sh2.57 trillion.

An audience follows proceedings during the Third National Wage Bill Conference at Bomas of Kenya on April 17, 2024.

Experts now warn that the trend poses a major challenge for the government that is trying to lower the wage bill burden, as it continues to eat into funds that ought to be invested in development projects.

“Kenya’s public wage bill is far above what is required to be paid in a normal economic environment. Wages are eating into revenues that ought to be put to development projects, which have huge economic implications for the country,” says Samuel Nyandemo, a University of Nairobi’s Economics professor.

Prof Nyandemo also observes that there has not been a correlation between larger numbers and productivity in the public workforce, raising concerns of possible dead weight being sustained at the expense of taxpayers.

The International Labour Organisation (ILO) ranked Kenya at 155 out of 189 countries globally in labour productivity in 2023, with countries such as Botswana, South Africa and Djibouti ranking higher than Kenya.

SRC, however, notes that despite productivity being a key component of employment, Kenya’s public service operates without a standardised recognition of performance and output.

In computing the public wage bill, SRC considers salaries/wages, allowances, bonuses, overtime payments, pension, gratuity, and medical cover benefits, among others.

Public resources

“The sound management of the public wage bill is critical in ensuring its affordability and fiscal sustainability. This further ensures that the wage bill does not eat into the public resources that would otherwise be used for development and delivery of essential social services to the citizenry,” the Commission says.

In the counties, wage bill costs averaged Sh54.7 billion quarterly in the last financial year, taking up 47.5 percent of all revenues the devolved units had generated.

In the report for budget implementation in the year to June 2025, the Controller of Budget (CoB) said the national government spent Sh645.5 billion on salaries and allowances, excluding salary-related payments for the National Intelligence Service (NIS) and Kenya Defence Forces (KDF), as well as Semi-Autonomous Government Agencies and State Corporations.

The government originally planned to spend Sh594.9 billion on the salaries but the figure was changed in subsequent budget revisions.

During the year, departments with highest spending on salaries included TSC (Sh369 billion), National Police Service (Sh89 billion), the State Department for Correctional Services (Sh28 billion), and the State Department for Internal Security and National Administration (Sh16.25 billion).

The Judiciary (Sh15.27 billion) and the National Assembly (Sh12.13 billion) were also among high spenders on the wage bill perspective.

Prof Nyandemo says the government needs to embrace technology to boost the productivity of its workforce and clean up the public payroll of ghost workers, rather than adding numbers needlessly when output remains low.

“We need to embrace technology and invest heavily in ICT. We can’t just focus on hiring more and more workers. We also need to address the issue of ghost workers since there are many people earning public funds who shouldn’t be in the payroll,” he says.

SRC is seeking to implement resolutions from the third wage bill conference held last year, aiming to lower the public wage bill to 35 percent of taxes by 2028, but if the trend continues, the goal may not be achieved.

The commission notes that less than a third (31 percent) of the indicators to aid achievement of the targets have been fully completed, implementation of 41 percent of them is in progress, and 28 per cent had not been implemented by May.

It is expected that full implementation of the indicators, including a crackdown on many allowances paid to public workers, will help the government control the wage bill.